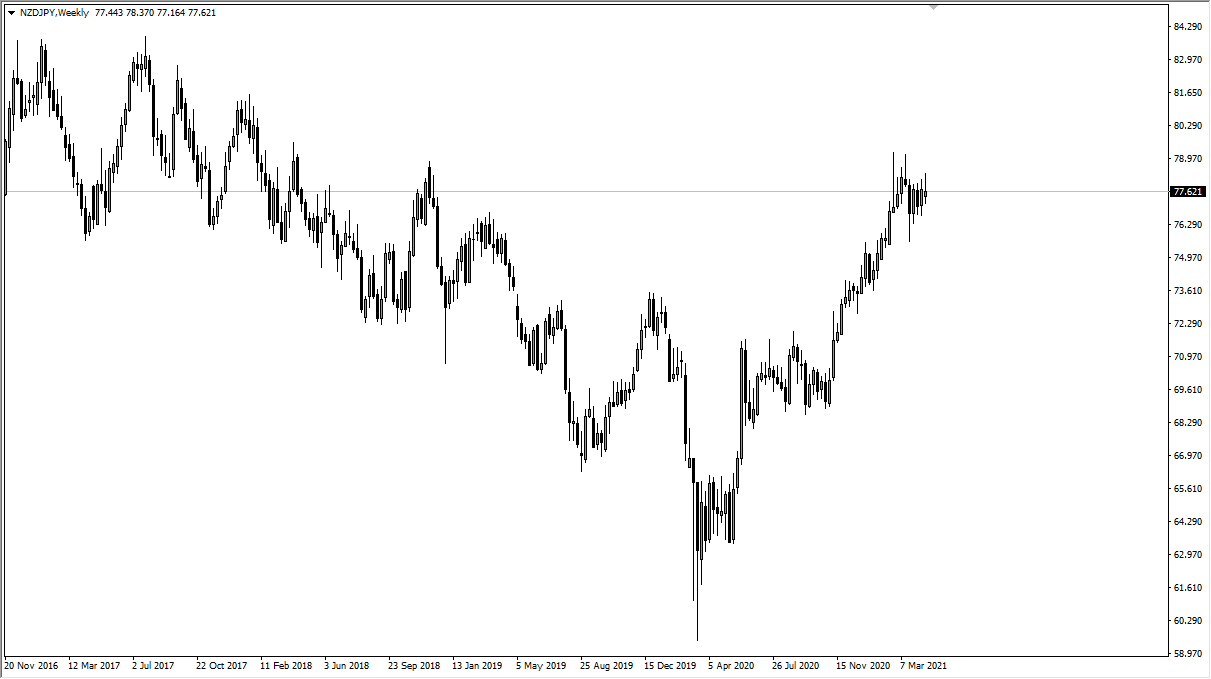

NZD/JPY

The New Zealand dollar initially shot higher against the Japanese yen during the course of the week but gave back most of the gains to form a shooting star, and is becoming a relatively common resistance barrier in the form of ¥78. This does suggest that perhaps we may be running into some issues when it comes to risk appetite, so keep an eye on the chart. Even if you do not trade this pair, it is most certainly a great barometer for risk appetite.

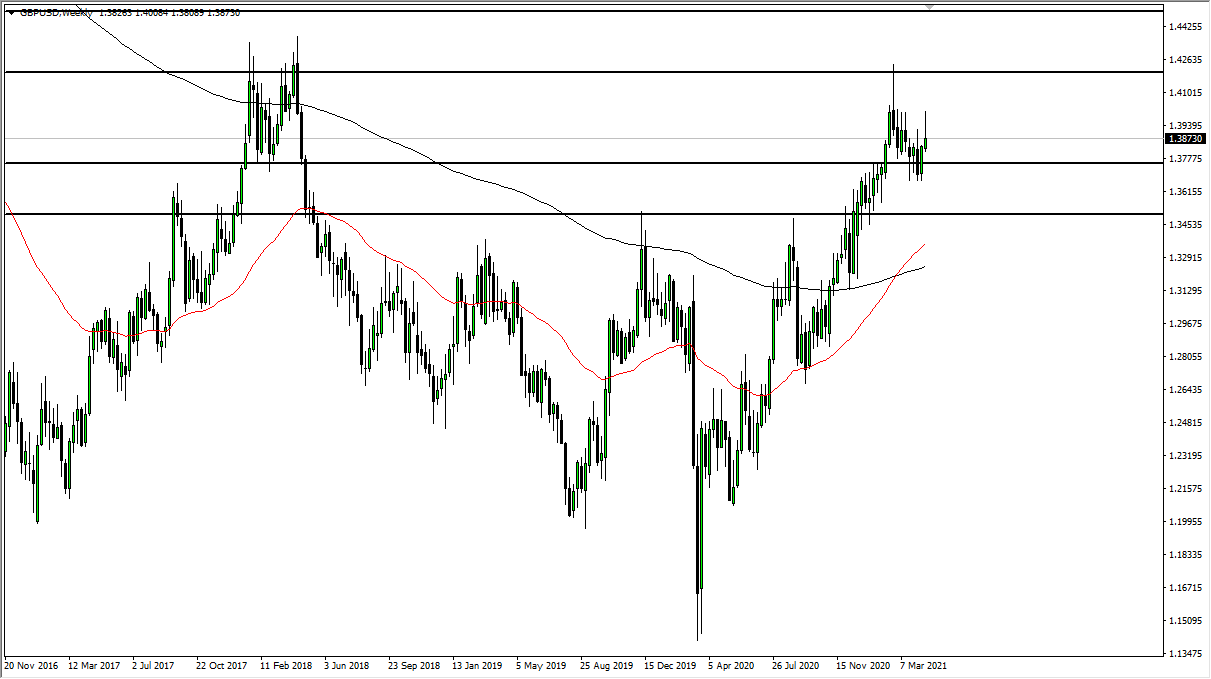

GBP/USD

The British pound has shot higher as well, but also gave back the gains to show signs of weakness. The shooting star is less than impressive, and I think this will continue to suggest that the market really has nowhere to be. However, if we were to turn around and break above the 1.40 level, that opens up a move to much higher levels. In the meantime, it looks like we are going to continue to go back and forth and simply “kill time” in this general vicinity. Underneath, if we break down below the lows of the last month, that could open up a move down to the 1.35 handle.

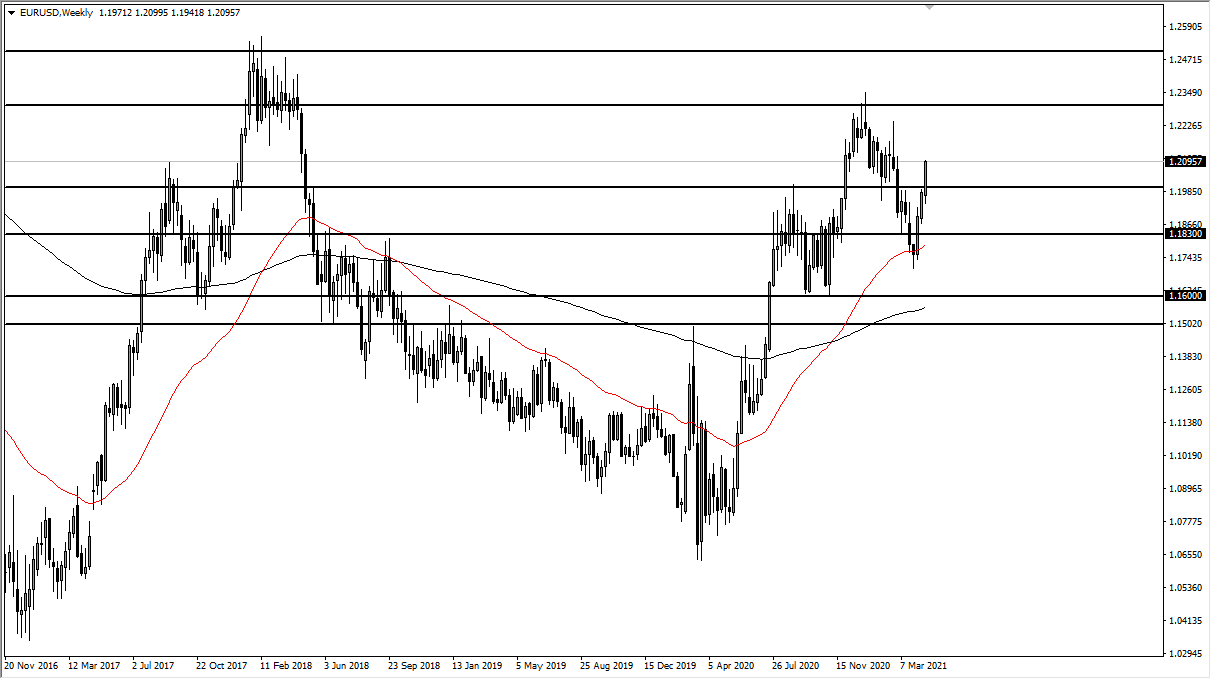

EUR/USD

By far the biggest winner of the week was the euro, as it closed at the very top of the range. We are sitting just below the 1.21 handle, but we are also facing a lot of resistance between here and the 1.22 handle. A pullback would not be a huge surprise, so I am very cognizant of staying out of a “chase the trade” type of situation. I think we will continue to hear a lot of noise, but at the end of the day I do believe that we could go looking towards 1.23, unless the US dollar strengthens across the board.

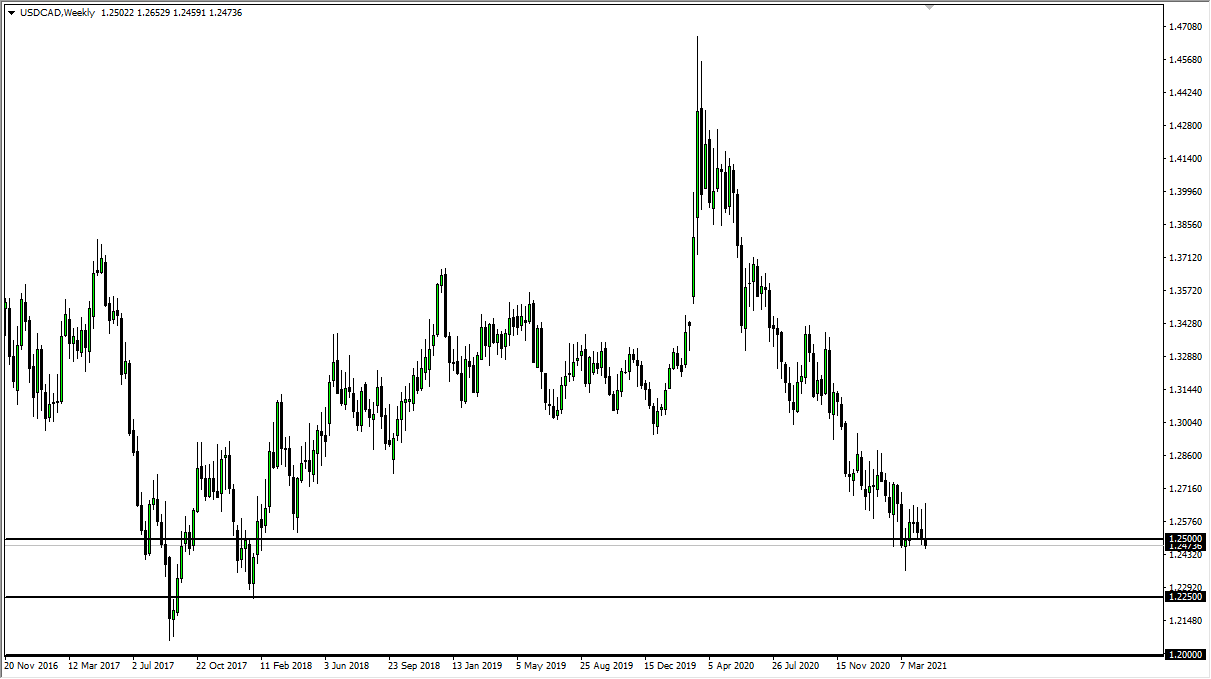

USD/CAD

The US dollar initially tried to rally against the Canadian dollar, but as you can see for the last month, we continue to see sellers. By selling off the way we have, we have broken below the 1.25 handle, which is a large, round, psychologically significant figure. Nonetheless, pay close attention to oil, as it is rather quiet, so it could have an effect on this market and thereby subdue the downward pressure. If we break above the highs of the last month though, that could lead to a major turnaround. As far as breaking below here, then the market probably goes looking towards 1.2250 handle.