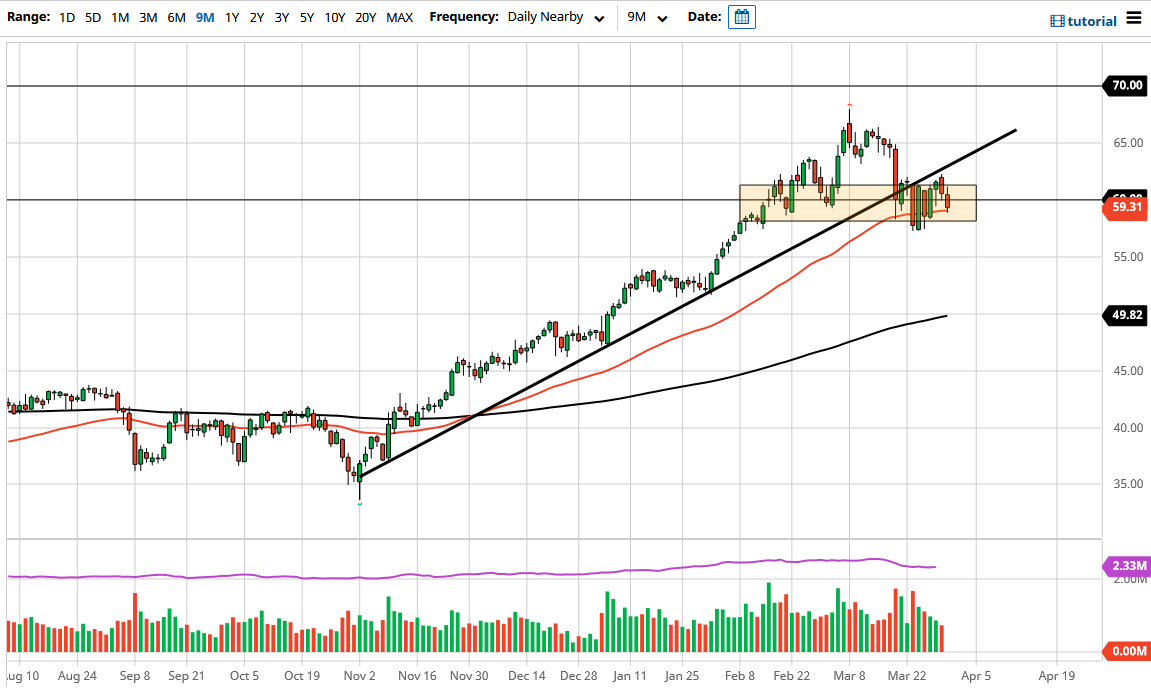

The West Texas Intermediate Crude Oil market initially rallied during the day on Wednesday as we continue to dance around the $60 level in general. At this point time, we rally but then found sellers later in the day as we have since gone negative. The market is sitting on top of the 50 day EMA now, and therefore think a certain amount of technical trader influence could find itself in the market. That being said, I think that a lot of this comes down to simply “killing time” and trading on the latest rumors.

The reason I say that is that OPEC+ is currently meeting, and a lot of people are going to base the next move in this market on whatever it is they decide about the production cuts and whether or not they will extend them through the month of April. Most traders out there believe that Russia will push for this to happen, so that being said it does make quite a bit of sense that we would see the markets already pricing that in. At this point, the biggest shock would be if OPEC+ did not extend cuts.

That being said, the inventory figures on late Tuesday in America were less than encouraging. I think at this point people are starting to wonder whether or not the oil market still has the momentum to continue going higher, and whether or not it is sent overdone? I can tell you flat out that it is most certainly overdone, but a lot of people are trying to base the trade on what could happen in the future as far as the reopening trade is concerned, but we also have the US dollar strengthening, which in and of itself can cause some issues for this market.

In the meantime, I suspect that this market simply go sideways in the same range we have been in for the last couple of weeks, but eventually we will break out of this little consolidation area on a daily close. Once we do, I will be following in whatever direction we show. By breaking down below the bottom of the range, then I will be aiming for the $52.50 level. If we break above the top of the range that we have been in, then I am looking at the $65 level.