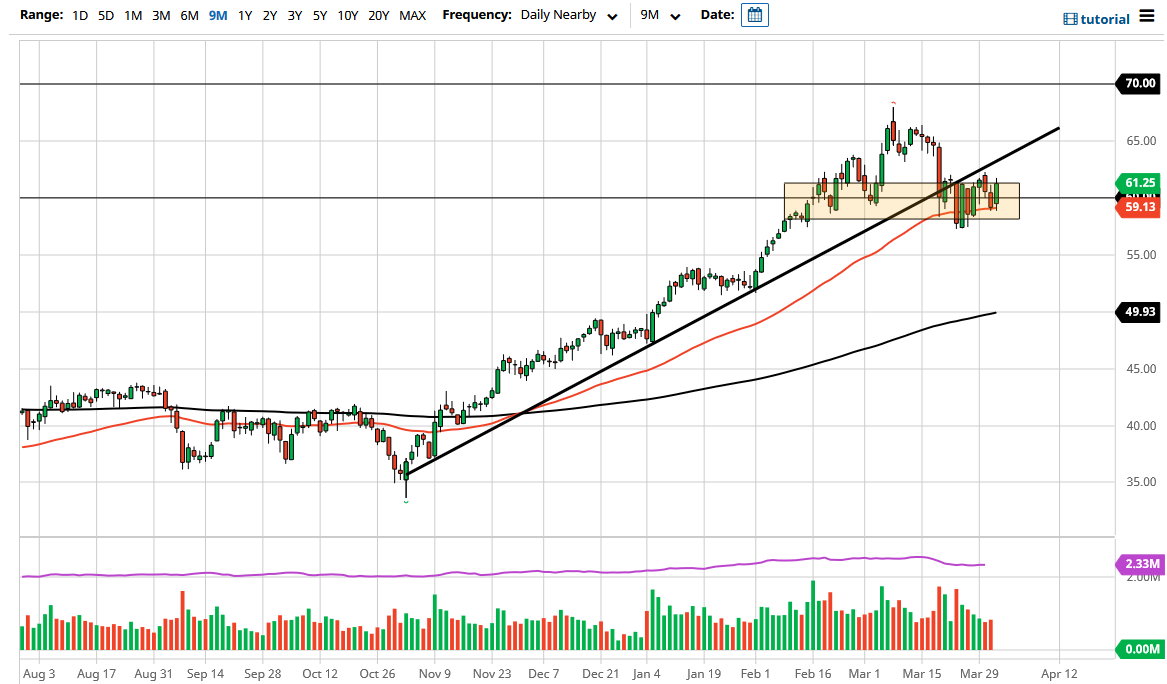

The West Texas Intermediate Crude Oil market has gone back and forth quite drastically during the trading session, mainly based upon the latest rumors coming out of the OPEC meeting. As the day has gone by, there have been various “official sources” reporting different things as far as whether or not the production cuts will be extended, and this of course has caused a lot of back-and-forth trading. At the end of the day though, we are simply in an area of consolidation while we try to figure out where to go next.

It is worth noting that the 50 day EMA underneath has offered a significant support level over the last couple of days, so with that being the case it is likely that we will continue to see it offer a potential bounce off of short-term charts. That being said, the market also has support just below there at the $57.35 level. If we were to break down below there, the market is likely to go looking towards the $52.50 level, and because of this I think we will continue to see traders pile into the trade if we do in fact break down. This would more than likely be due to increase production.

On the other hand, there seems to be a significant amount of resistance near the $62 level, so if we were to break above there then we will retest the previous uptrend line, and then perhaps go looking towards the $65 level next. This is a market that is simply waiting for the next catalyst, which could come at roughly any time and of course it will be until we get the actual official announcement that OPEC has decided what to do next.

That being said, we have broken through a major uptrend line and we are sitting with a flat 50 day EMA. All things being equal, this is a market that I think will make a bigger move soon, but keep in mind that it is Good Friday so there will be a majority of traders away from the desk during the day, so that being said, I think this is a market that is simply going to do nothing until we get a bit of certainty. At this point, this is a situation where it is a matter of sitting and waiting to let the market tell you what to do.