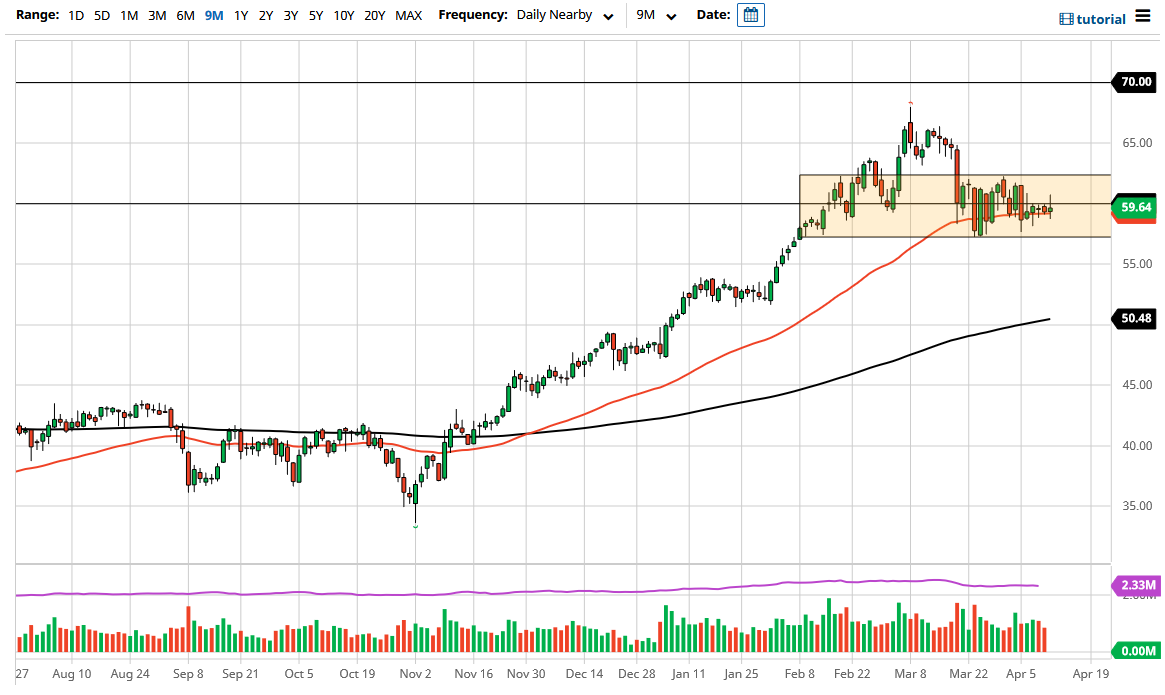

The West Texas Intermediate Crude Oil market has been very choppy over the last couple of weeks, and it looks as if the range is tightening. The candlestick from the trading session on Monday was essentially a shooting star, sitting on top of the 50 day EMA. We continue to form shooting stars, neutral candlesticks, and then hammers, as we hang about the $60 level.

If we break down below the bottom of the candlestick for the trading session on Friday, then the market is likely to go looking towards the $37.50 level. Ultimately, if we break down below that level, then it is possible that we open up a move down to the $52.50 level. On the other hand, if we were to turn around and break above the $62.50 level, then the market is likely to go looking towards the $65 level. It looks like we are simply looking for some type of catalyst to get going.

When you look at the WTI Crude Oil market, you have to keep in mind that the situation in this market is a bit of a moving target, due to the fact that the coronavirus issues in the European Union continue to be a problem, as we are starting to see signs of a lockdown coming. Furthermore, we also have OPEC talking about extending production slowly over the next several months, which works against the value of crude oil.

On the other hand, we also have the idea of the reopening trade coming into the picture, driving up demand for crude oil. If that is going to be the case it is likely that we would see this market go higher, but right now it certainly looks as if it is struggling and I think suddenly we are going to see some type of move rather soon. We do not have it yet, so if you are a short-term trader, you will probably like pushing this market back and forth on short-term charts. As far as a longer-term chart is concerned, we need to break out of the consolidation area that we have been in that I have marked on this chart. Until that happens, it is just going to be noise, and therefore it is difficult to imagine putting a lot of money to work without some type of confirmation. Right now, it is a matter of waiting.