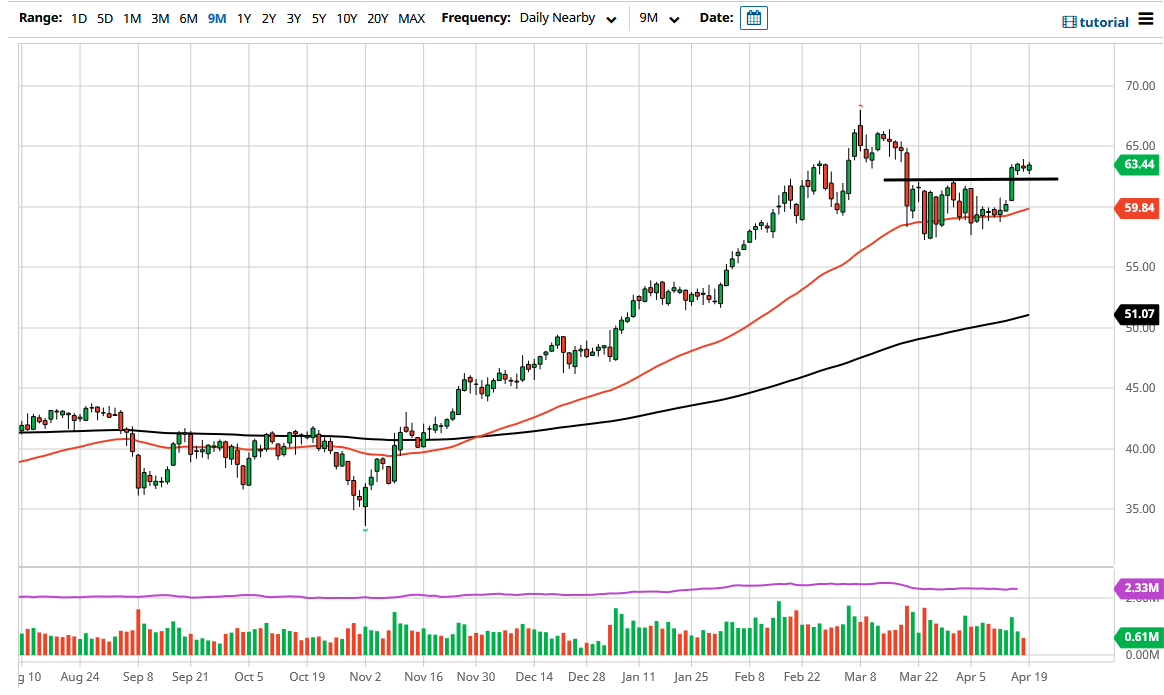

The West Texas Intermediate Crude Oil market has done very little during the trading session yet again, as it looks like we are simply “killing time” before some type of bigger move. It is worth noting that we broke above the $62.50 level, and now have been killing time in this area and building up the possibility of accepting the price, and then continuing the uptrend.

Crude oil is being pushed around by the idea of the reopening trade and the idea that economies around the world are going to be opening up rather quickly. However, we also have to worry about the coronavirus figures that are climbing around the globe with perhaps the exception of the United States, so this will have a major influence on what happens with oil. After all, the numbers in places like India and Brazil are still stubbornly high, which is bad news for oil, as India is the third largest crude oil importer, and Brazil is just below there.

The US dollar has its influence as well, so the fact that the US dollar fell as hard as it did during the session and oil was only slightly positive tells you just how lackluster the performance was. If we can break above the shooting star from the Friday candlestick, then it is likely that we would go looking towards the $65 level. The $65 level is where we had seen significant selling previously, so it makes sense that we would see a bit of a pushback in that area. If we can break above there, then we will almost certainly go looking towards the highs.

On the other hand, if we break down below the $62.50 level, it is likely that we could go down to the $60 level, where the 50-day EMA comes into the picture. The 50-day EMA is a technical indicator that a lot of people will pay close attention to, as the 50-day EMA is dynamic support and resistance. You can see that there has been a lot of consolidation in this general vicinity, so with that being the case it does make sense that there would be plenty of interest in this market at that level. If we were to break down below it, then we could have a significant correction. I think the only thing that we will be able to count on is choppy behavior.