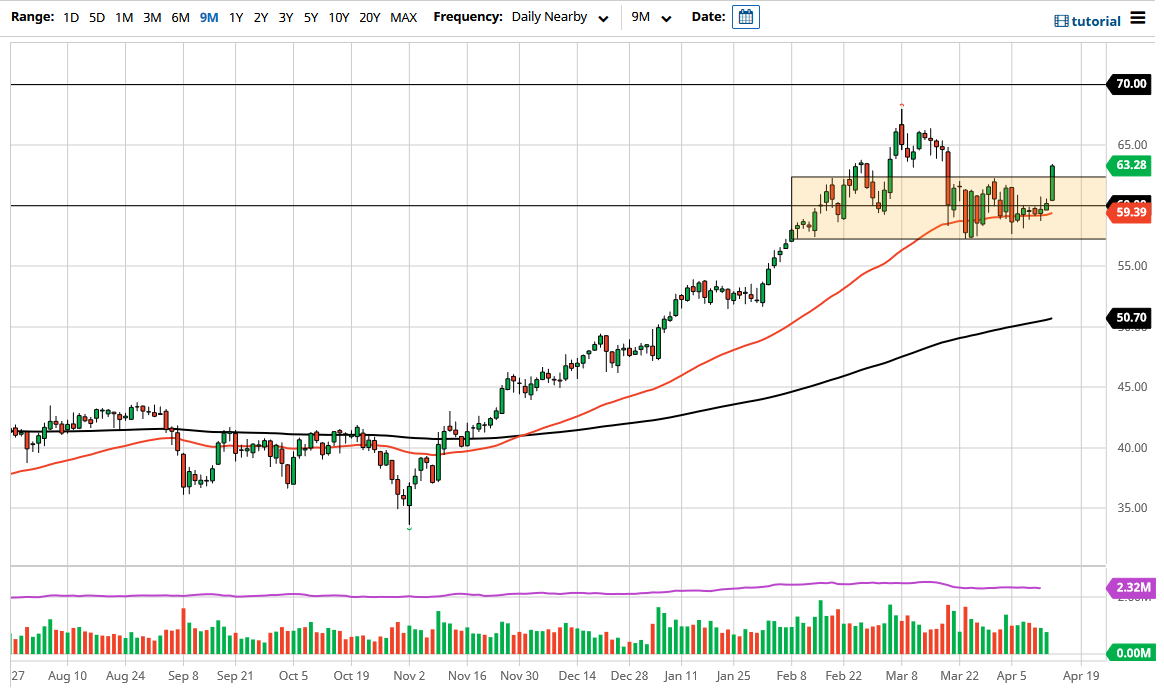

The West Texas Intermediate Crude Oil market broke out during the trading session on Wednesday, as we have cleared the top of the short-term range that we have been in. Furthermore, we have closed at the very top of the range, which should continue to suggest that we will have buyers. Typically, when we see a close at the very top of the range, that normally means that you will get a certain amount of follow-through the next day. I believe at this point it is likely that we will go looking towards the $65 level, which is where we had seen a significant amount of selling happen previously.

To the downside, I believe that the $60 level is significant support, as it also features the 50-day EMA. That being said, I think this is a market that continues to see a lot of choppy behavior, and I will be paying close attention to not only the $60 level, as it is a large, round, psychologically significant figure, but we also have the 50-day EMA sitting just below it.

If we were to break down below the 50-day EMA, then we will more than likely reach towards the $57.50 level underneath, which was the previous support level. If we were to break down below there, then I think it kills the uptrend and we will go much lower, because not only will we have broken out significantly, but we will have turned around and fallen apart after that attempted breakout.

Both the IEA and OPEC both raised their demand forecast for the year, and that drives up the idea of demand for crude oil. Ultimately, I think this is a market that will see quite a bit of demand due to the “reopening trade”, so it does make sense that we would see oil rally. However, there are a lot of questions as to whether or not shale will come into the picture, and we have to worry about the coronavirus flaring back up in places like the United States and the European Union, although the US is in much better shape than the EU. In other words, even though traders are starting to look forward, we will get the occasional noise coming out of COVID.