The West Texas Intermediate Crude Oil market rallied during the trading session on Tuesday to break above a minor resistance barrier. In fact, we managed to close towards the very top of the candlestick, so that suggests that we should have a bit of follow-through. This makes sense, considering that the market has received commentary from British Petroleum and OPEC that demand for the year should be picking up in places like the United States and China. There was even talk about Europe picking up a little bit of demand as well, so that could also help the oil market.

What is interesting is that the market is trying to look past the idea of Brazil, India and Japan all slowing down due to the coronavirus situation getting worse in those countries, so it is interesting to see how it looks like we are ready to continue going higher regardless. That being said, the market is likely to continue to see a lot of relentless pressure given enough time.

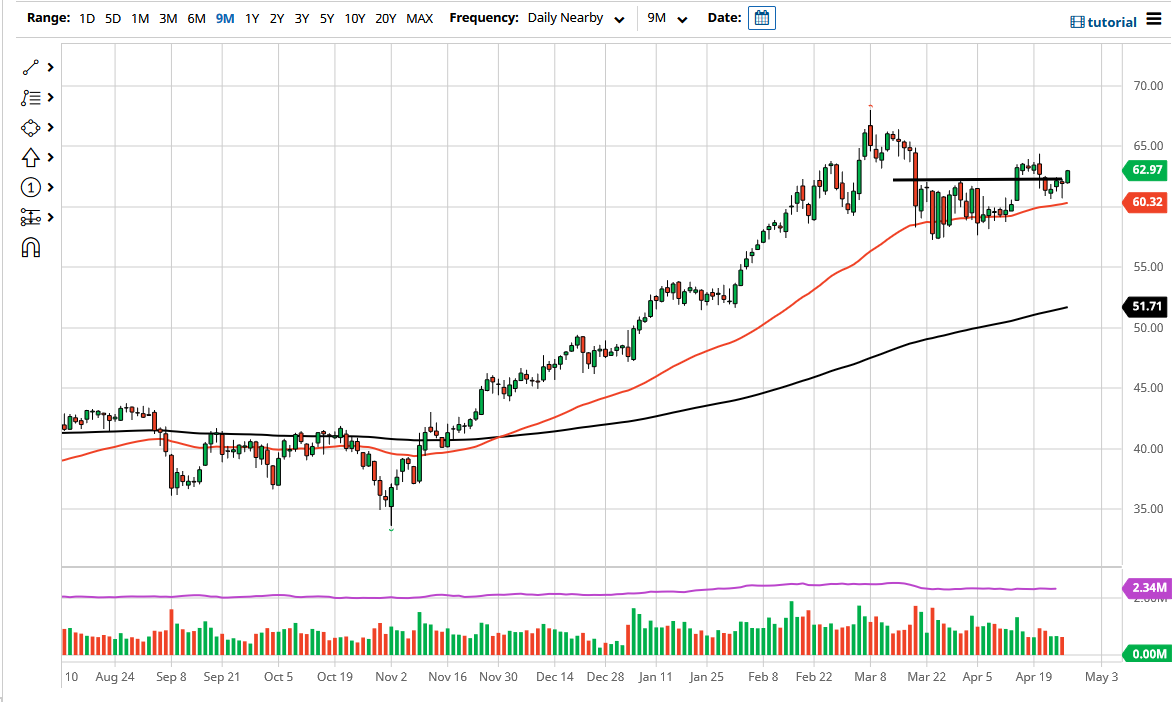

Just above, I see a lot of noise at the $64.50 level, so if we can break above there, then it is likely that the market would go looking towards the $65 level, and then possibly $67.50. To the downside, we are probably looking at a move down towards the 50-day EMA, which is closer to the $60 level. The market has been very strong for some time, so it is not a huge surprise to see traders coming back into the fold to pick up crude oil again.

If we were to break down below the 50-day EMA, then it is likely we will go looking towards the $57.50 level, as it is an area of significant support from which we bounced last time. If we were to break down below there, then things fall apart, but right now that does not seem very likely to be the case, as the risk appetite of traders around the world continues to show signs of life. I do not know if we can break above the recent highs, but it certainly looks as if we are going to try to at least get there and figure this out. Expect a lot of volatility, but it certainly looks as if traders are willing to come in and pick up dips.