The West Texas Intermediate Crude Oil market initially took off during the trading session on Tuesday, but then pulled back rapidly as European traders began to worry about increasing numbers of coronavirus infections in other parts of the world. The European stock markets closed horribly, and that certainly put a huge dampening on risk appetite, as most of the selling was seen during the European trading hours.

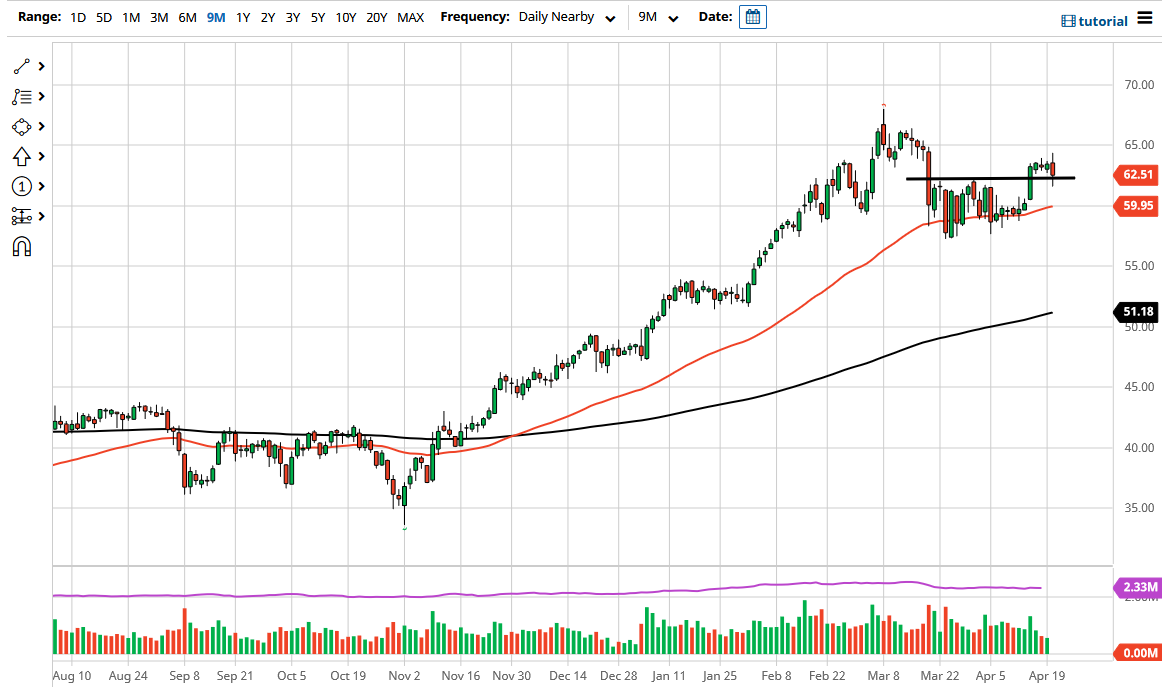

That being said, the Americans have turned the market back around, and we have found the previous resistance barrier at the $62.50 level as supportive. By doing so, it looks as if we are going to stay in the same range we had been in, so I think it is probably only a matter of time before we rally. However, this does not necessarily guarantee anything, rather it suggests that the buyers are coming in to pick up a little bit of value. If we do rally a bit, then we could go as high as $64.50, possibly even the $65 level, where we had seen a lot of selling from.

If we break down below the daily candlestick, then it is very possible that we would go looking towards the $60 level, which is where the 50-day EMA is currently sitting. At that point, the market would be re-entering the previous consolidation area, so I think there would be plenty of buyers involved. That being said, if we broke down below the $58.50 level, then we would probably see the crude oil market break down rather drastically. However, it is obvious that we have been in an uptrend for a while and, even though this has been a very noisy trading session on Tuesday, the reality is that the trend is still very much to the upside, and there is a certain amount of resiliency in the idea of the reopening trade.

The massive amount of excess crude oil that had been stockpiled during the coronavirus pandemic has essentially been drained, so we do not have the overhang of that going on. This is a market that will continue to see buyers on these dips, so it is probably only a matter of time before we go looking towards the highs again. However, oil is rather volatile, so you have to keep an open mind to the downside.