The crude oil markets rallied rather significantly during the trading session on Wednesday as we continue to look at recovery as driving demand much higher. Furthermore, OPEC+ and British Petroleum have both stated in the last 24 hours that they are looking for a gain of 6 million barrels in demand per day for the rest the year. If that is going to be the case, then obviously we should continue to see a lot of upward pressure.

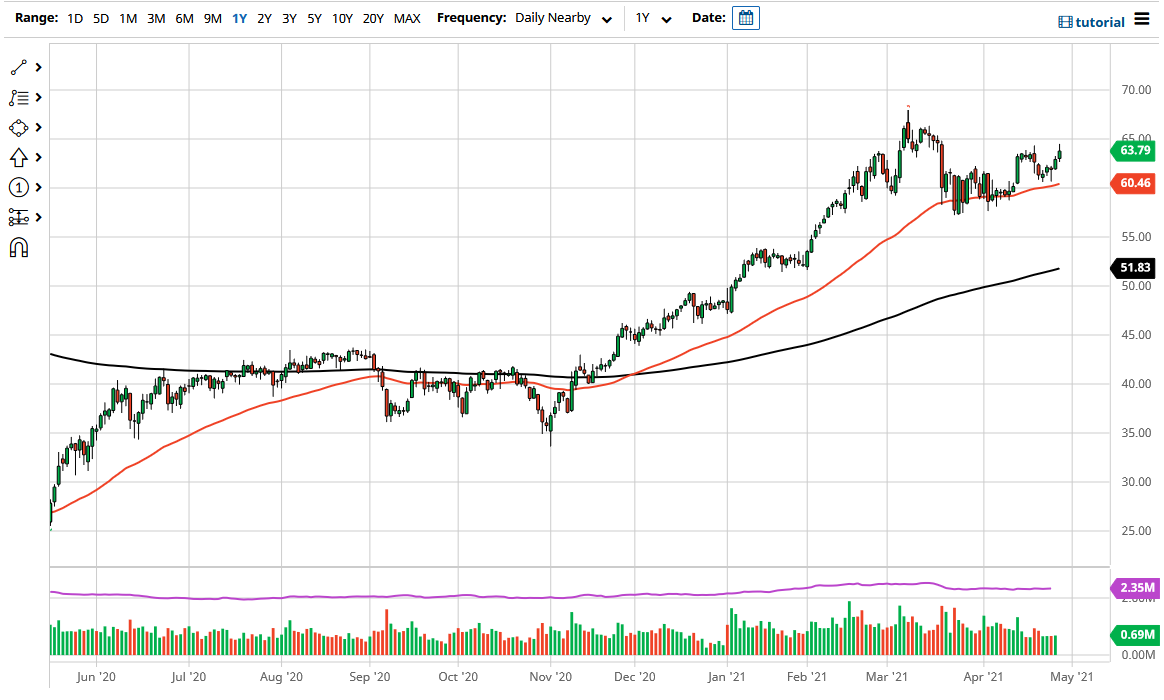

Beyond all of that, we have also gotten very close to getting rid of the excess glut of supply after the coronavirus pandemic shut everything down. If we are starting to get beyond the oversupply, then it is likely that we are ready to continue to see upward pressure as well. In fact, OPEC has suggested that the price of oil could go as high as $80, but right now I think we are simply looking at a market that is ready to continue to grind higher over the longer term, perhaps giving us a bit of a “buy on the dip” type of market in general. The 50-day EMA underneath sits just above the $60 level, so I think it is only a matter of time before the buyers take over. I do think that if we can clear the $65 level, it is likely that the market goes looking towards the $67.50 level, perhaps even the $70 level after that.

At this point, the market cannot be shorted until we break down below the $57.25 level, but if we did drop down below there, then I think it is only a matter of time before we break towards the 200-day EMA. The market is likely to continue to see a lot of volatility, but we are still most certainly bullish, and the recent noise has been more or less due to the volatility spiking and perhaps a little bit of consolidation after we had that massive shot higher over the last several months. As we continue to see markets around the world open back up, the lockdowns are starting to be lifted in general. As long as that is the case, then I do believe that we probably still are going to see more momentum to the upside than down.