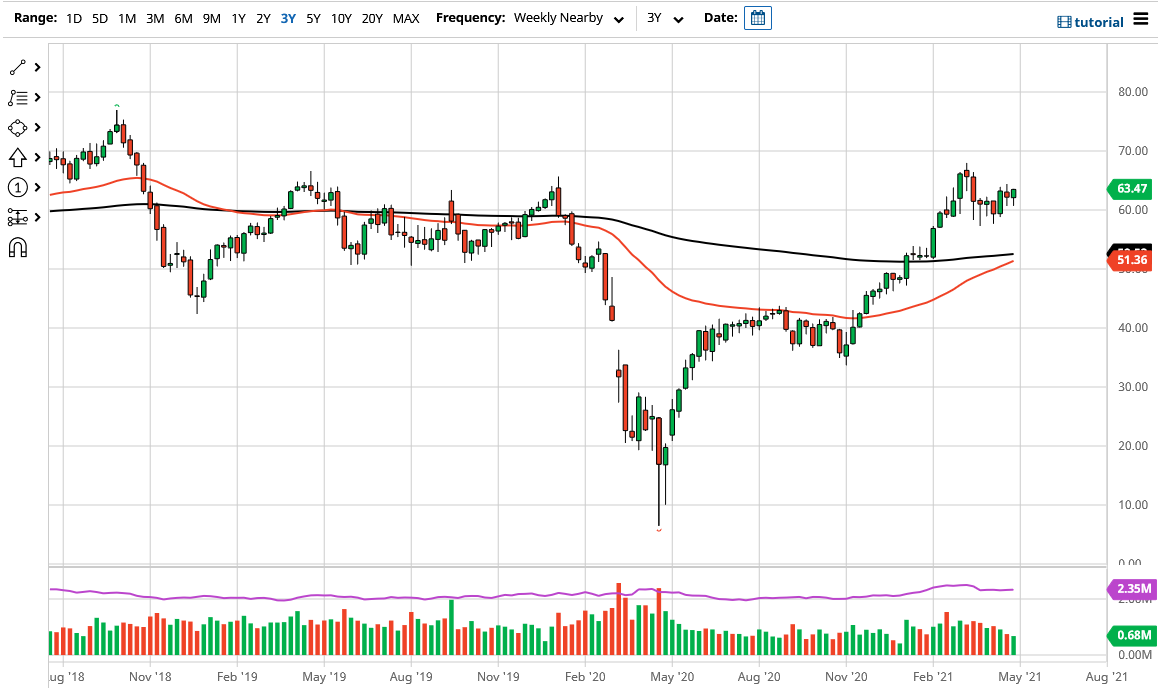

The crude oil complex has been a bit choppy during the month of April, but at the end we were starting to see a little bit of stability, perhaps pointing in one direction finally. The last couple of months have been somewhat noisy, but still have remained above the $60 level. At this point, the $60 level is without a doubt massive support, and I do believe that will continue to be the case going forward. The market will remain bullish as long as we can stay above there, and with recent developments, it does make sense that we could continue to see buying in this contract.

When you look at the recent fundamental news, one of the most important things that stands out is that OPEC+ and British Petroleum both have suggested that they believe demand will pick up by about 6 million barrels a day in the back half of this year, and as May typically begins “driving season” in the Americas, it is very likely that demand for end products like gasoline will only continue to rise over the next few months. Keep in mind that the American economy was locked down last year, so a lot of road trips will have been canceled. This year, it is expected to be much different, as the US is far ahead of other countries when it comes to the reopening.

To the upside, I see the $65 level as a momentary barrier, but it is probably only a matter of time before we break above there and then go looking towards the $67.50 level. By the end of the month, I fully anticipate that we will be there. I believe that this will be very choppy behavior in general for the month, but still in a general sense, very positive.

If we can break above the $67.50 level, then it opens up the next move, which would be to go towards the $70 level. $70 will be a massive barrier to get past because it is a large, round, psychologically significant figure and is an area that will attract attention; but it also has been massive resistance in the past. By the end of the month, I anticipate that we will be somewhere between the $67.50 level and the $70 level, but if we see enough momentum, it is possible that we will break through.

If we were to break down below the $57.25 level, that could very well have this market looking towards $50, although it does not look very likely to happen. At this point in time, I remain very bullish of crude oil, but I also recognize that the easy money has already been made.