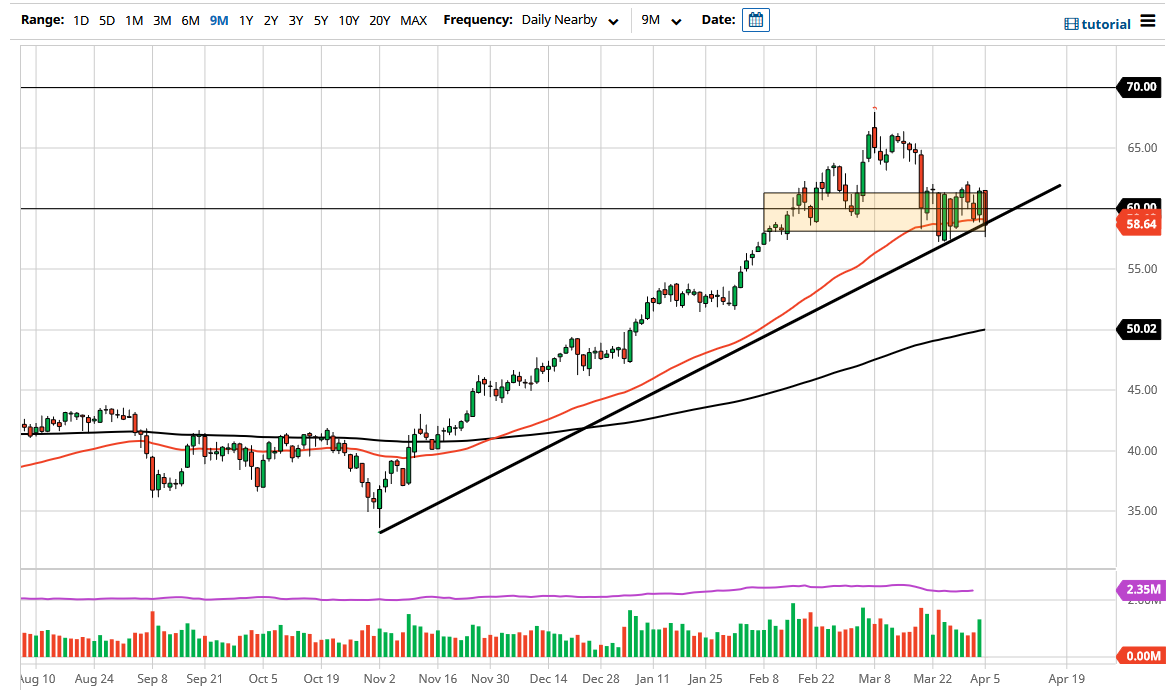

The West Texas Intermediate Crude Oil market has fallen significantly during the trading session on Monday as traders finally came back to work from the Easter holiday. However, we have popped back above the uptrend line that had been pierced, so it is at least trying to hang onto its uptrend. All that being said, if we break down below the lows of the trading session on Monday, I think that kicks off the next leg lower, based upon the massive 9% selloff we had seen a couple of weeks ago. Please tell me you have not forgotten that day.

Thursdays typically means something over the longer term, because when you take out 4 to 5 sessions in one candle, that means something has fundamentally changed. It is very possible that traders are starting to focus on OPEC and its production increases coming, and of course the fact that the United States will now be able to produce shale at a profit. All of that leads to lower oil prices eventually, but right now traders seem to be willing to hang on to the idea of the reflation and reopening trade. Whether or not the demand is going to be a strong as traders think is a completely different question, but at this point in time I think what we are seeing is a rethink.

The 50 day EMA sits just below current pricing, and therefore it does make sense that there would be a certain amount of interest in buying. However, if we were to break down below the candlestick on Monday, that probably kicks off a move down to about $54 or so. There is also the possibility that we turn around and continue to go higher, but obviously we need to see some strength come back into this market. I anticipate that a move above $62.25 would kick off a move towards $65, and anything is possible at this point. Having said that, this is a market that tends to be very choppy and now we are seeing volatility expand a bit and therefore it makes quite a bit of sense that we see these candlesticks going back and forth overall with the $60 level being the fulcrum for price. With this, I think we are getting close to a bigger move, and we should see that the next couple of days.