The West Texas Intermediate Crude Oil market rallied significantly initially during the trading session on Tuesday but gave back the gains towards the end of the day. The crude oil market is still looking likely to cause a lot of headaches for traders going forward. With that in mind, I believe that the market will continue to see a lot of noise, so you should be cautious about your trading position.

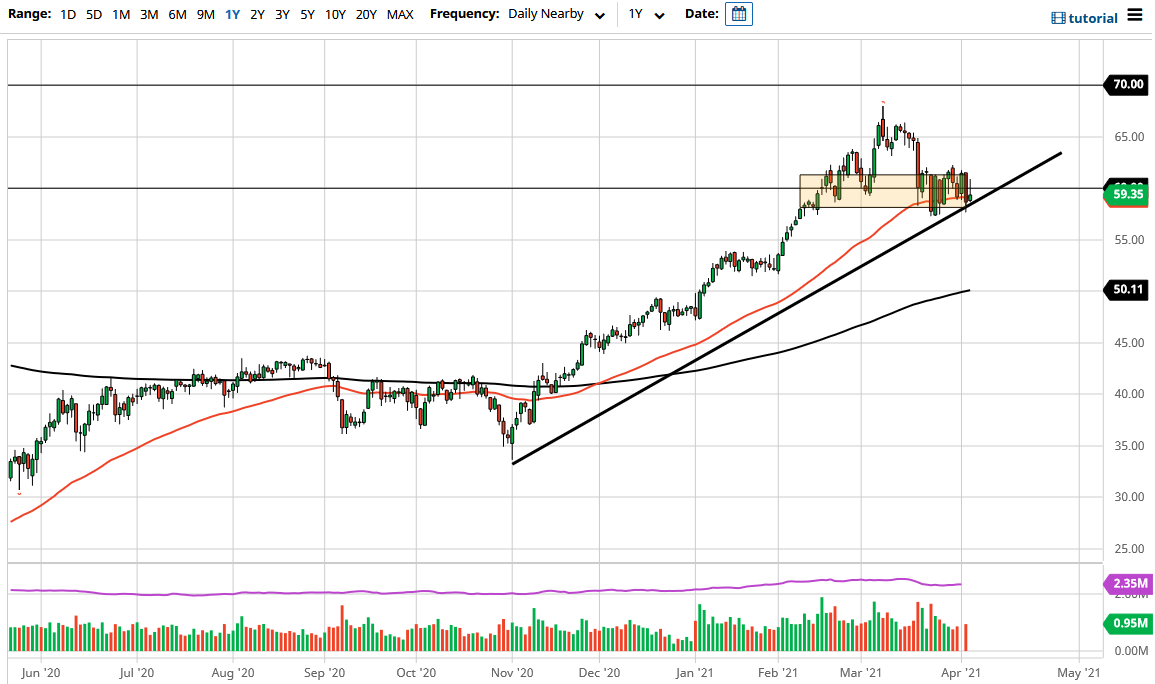

Looking at the shape of this candlestick, it certainly looks as if crude oil is being threatened, so a breakdown could be a real possibility. At this point, if we were to break down below the lows of the trading session on Monday, oil could start to fall yet again, perhaps reaching down to lower levels around the $53.50 level. The next level is the $50.00 level, which is a large, round, psychologically significant figure and also features the 200-day EMA.

If we were to turn around and break to the upside and clear the $62 level, it is likely that the crude oil market will go looking towards the $65 level, possibly even the $67.50 level. The upside is probably just as limited as the downside, because this is a very “tight market” at the moment.

The recent announcement that OPEC is going to gradually increase production has worked against the bullish behavior of this market, but at the same time people are starting to wonder whether or not Europe is ever going to have significant demand again, based upon the fact that they simply cannot get vaccines out into the general population. Ultimately, this is a market that is testing a major uptrend line, and if we can break down below there, it is likely that we would see a little bit of a breakdown in that general vicinity. However, if we were to break out to the upside, it is very likely that we will test those highs again, but I think $70 is going to continue to be a bit of a massive psychological barrier for this market, so I do not anticipate that we are going to break through there anytime soon. You could even go so far as to say that we are in the process of forming a little bit of a “head and shoulders pattern” as well.