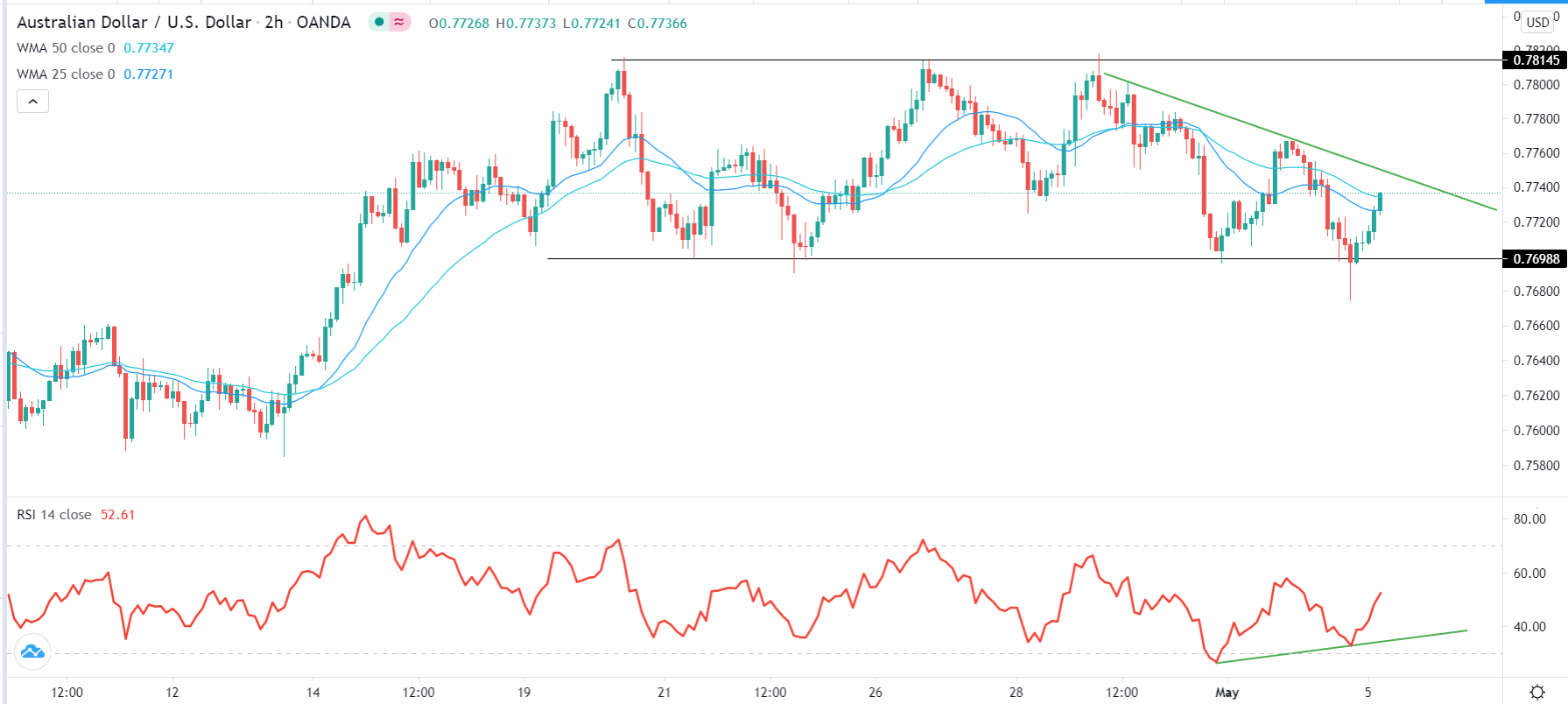

The Australian dollar broke down a bit during the trading session on Tuesday to reach towards the 50-day EMA. The 50-day EMA is a significant technical indicator that a lot of people pay attention to, and you can see that the market has clearly flipped back and forth right around this indicator. The candlestick is negative, but the fact that we recovered enough to break back above the 50-day EMA suggests that there are a certain amount of buyers sitting just underneath.

The top of the candlestick at the 0.7760 level suggests there is significant resistance there, especially considering that the market has seen selling there through multiple sessions. Obviously, the 0.78 level above has been a massive resistance barrier that the market cannot get above, so if we did break above there it would be a huge bullish sign and could send this market looking towards the 0.80 level. That is an area that has been massive resistance as well, and if you look at the monthly charts, you can see that there is a significant amount of resistance that extends to the 0.81 level as well. If we can finally get above there, then it is likely that we go looking towards the 0.90 level. This could become a bit of a “buy-and-hold” type of situation.

When you look underneath, if we were to break down below the bottom of the candlestick for the trading session on Tuesday, it could open up a move down to the 0.76 handle. That is an area that has offered support previously that extends down to the 0.75 handle. The 200-day EMA is reaching towards the 0.75 handle, so I think it is only a matter of time before the buyers return. However, if we were to break down below there then the Australian dollar probably breaks down rather significantly, perhaps losing another 500 points rather quickly. In that scenario I would be short, but I would also be paying close attention to the 0.70 level as it will attract a certain amount of attention. Breaking down below there it opens up a massive breakdown and could send this market into a freefall in general. Ultimately, I think we will see a lot of choppiness in the short term as we wait for the jobs number on Friday.