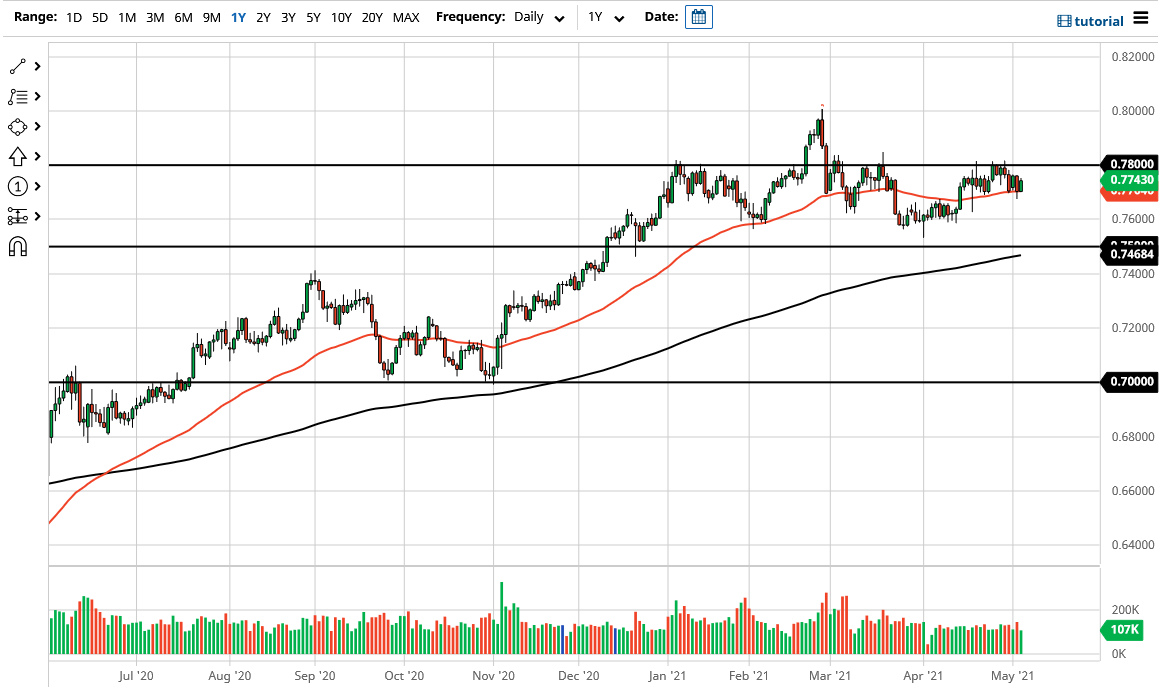

The Australian dollar rallied a bit during the trading session on Wednesday as we continue to see a lot of interest right around the 50-day EMA. The 50-day EMA is a significant indicator that a lot of people have been following as of late, and as you can see, the market has respected it multiple times and in both directions. You can also clearly see that the 0.78 level above has been a major resistance barrier, and I think we are going to continue to struggle to get above it. With this being the case, the market is very likely to continue to see a lot of resistance in that area, as we are trying to build up the necessary momentum to break out above there.

The market breaking above that 0.70 level could give a push towards the 0.80 level rather quickly, an area that has been significant resistance more than once. In fact, that shows up on monthly charts quite obviously, and it is a place where we see a “flip” in prices on longer-term charts. With this being the case, I think if we can break above the 0.81 level, we will have sliced through all of the resistance that keeps the market down and could open up a move all the way to the 0.90 level. I do not think that will happen very easily, though, so I think it is only a matter of time before we continue to see pullbacks. Nonetheless, if we were to break out above all of that area, I would become a “buy-and-hold trader” as it would become more of an investment.

More likely than not, we will continue to see sideways action that chops up accounts if you are not careful. Furthermore, we also have the jobs number coming out on Friday, which is going to be very influential as to where this market goes. If we do break down, the 0.76 level should be massive support. Furthermore, I think that it extends down to the 0.75 handle, which would be a massive floor. If we break down below there, then I think the Aussie drops 500 points. The market will continue to be very noisy, so you have to be very cautious and I think position sizing will probably be paramount.