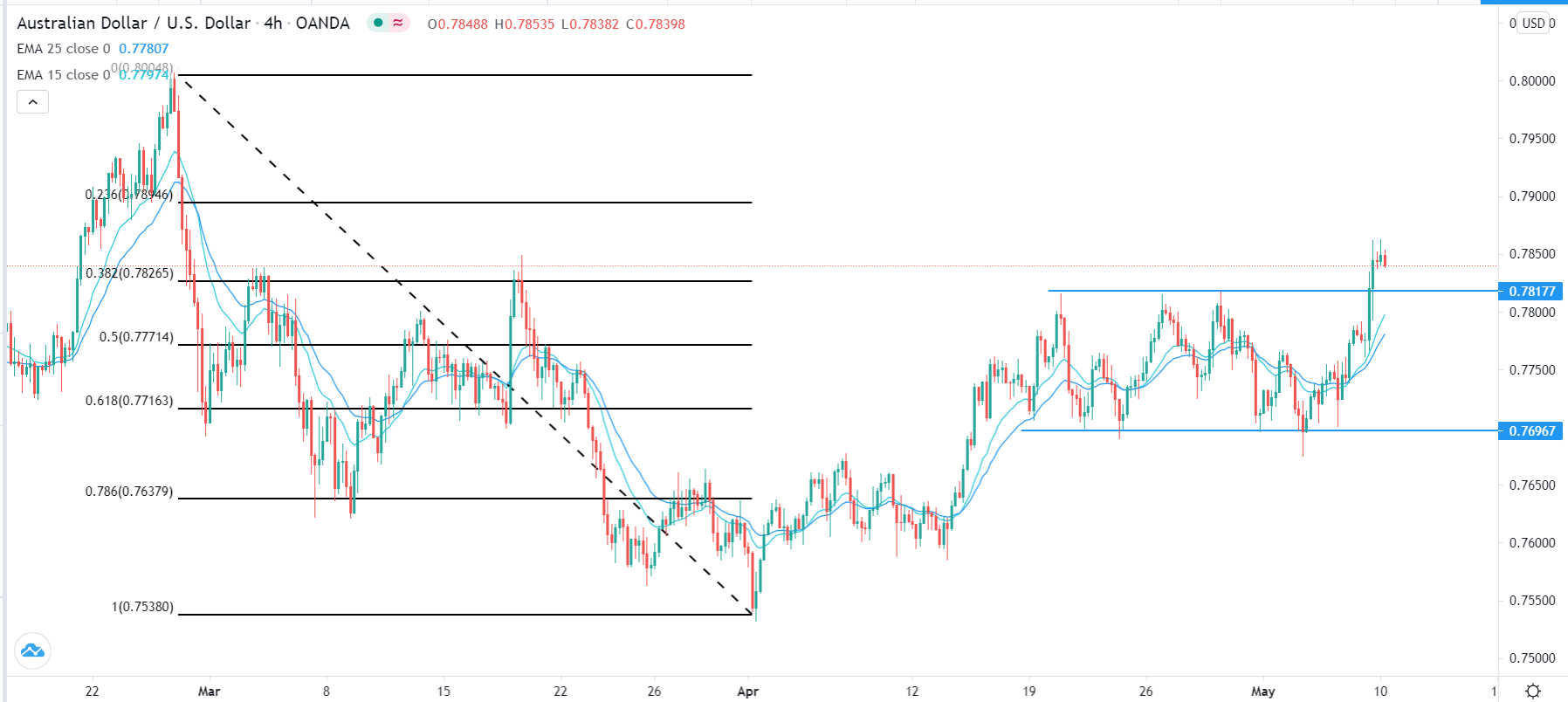

The Australian dollar broke higher during the trading session on Friday as the jobs number came out at just 666,000, instead of the 1 million anticipated. The market is likely to see more pressure on the greenback as the United States simply cannot stop spending, and it is likely to do even more. Furthermore, if yields continue to see pressure, it is likely that the greenback will suffer as a result. There are concerns about inflation at this point and that has been driving money into commodities. Remember, the Australian dollar is highly correlated to the commodity markets, especially metals.

I think this market is going to continue to find support near the 0.78 handle, and most certainly below there at the 50-day EMA. The 50-day EMA is sitting at the 0.77 handle, and it is likely that we would see a significant amount of buyers in that area. Nonetheless, the fact that we are closing above the 0.78 for the first time suggests that we will eventually go looking towards the 0.80 level.

The market is likely to continue to see a lot of volatility, but this breakout and the huge miss on the jobs situation is more than likely going to continue to put pressure on the greenback. The 0.80 level above is crucial from a longer-term chart standpoint, and if we can break above the 0.81 level, then the market is likely to go looking towards the 0.90 level above. That becomes a “buy-and-hold” type of situation, and I think what we are looking at is an opportunity to get long of a market for quite some time if we get that breakout. The Friday candlestick might be the first attempt to make that a reality. As far as selling is concerned, I have no interest in doing so until we crash through the 0.75 handle. If we were to break through that level, then we probably drop all the way down to the 0.70 level. Nonetheless, that is looking less and less likely going forward, so I think we will continue to find buyers on dips going forward as we have seen over the last couple of months.