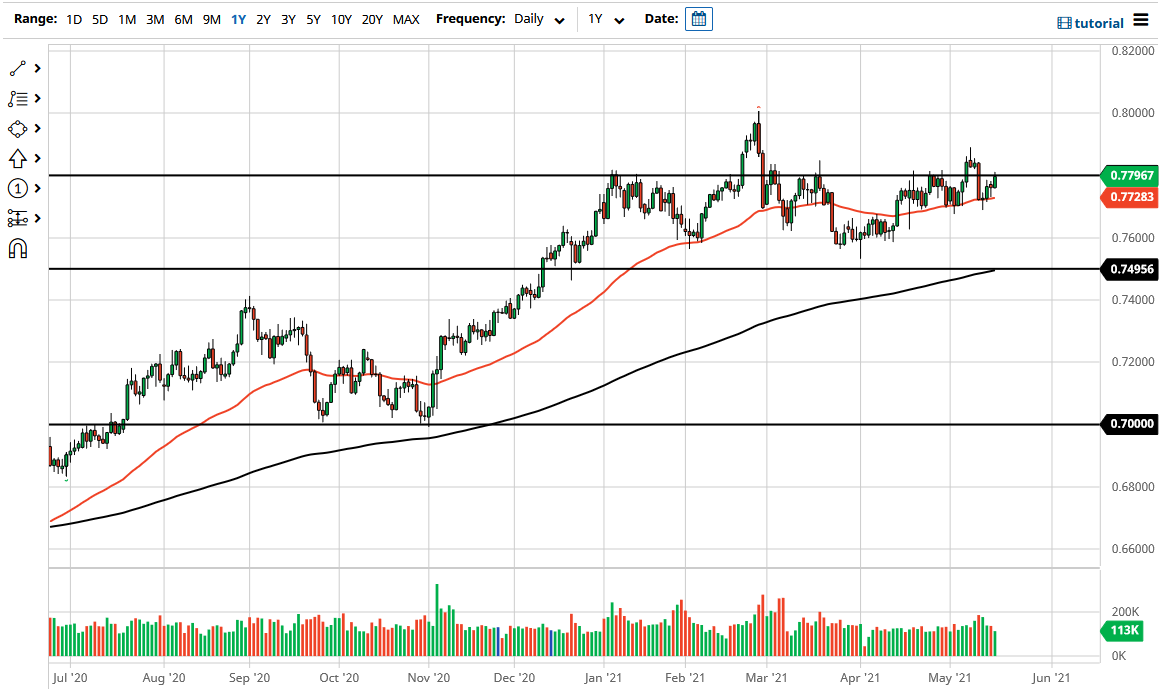

The Australian dollar rallied again during the trading session on Tuesday to reach towards the 0.78 level. This is an area that has been important multiple times, so I think it should not be surprised that we have stalled in this general vicinity. That being said, we have broken through here once, so I think it will be easier for this to happen yet again. At this point, the market is likely to see a lot of upward pressure, but that does not mean that we can suddenly shoot straight up in the air easily.

When you look below, the 50-day EMA is offering relatively significant support, and as you can see, the 50-day EMA looks to be tilting to the upside. The market is even trying to form some type of ascending channel, which is something that a lot of people will be paying close attention to. In other words, if we get a short-term pullback, we may see plenty of support in order to get long again.

To the upside, if we can break above the top of the shooting star from the highs that we just made, then the market is likely to go looking towards the 0.80 level above. The 0.80 level is a large, round, psychologically significant figure, but it is also a major resistance barrier that lasts for the next 100 pips on the longer-term charts. Because of this, if we can break above the 0.81 handle, the market is likely to really start to build up pressure to the upside, as we could have an open run all the way to the 0.88 level, possibly even the 0.90 level.

To the downside, if we were to break down below the 50-day EMA, then I think the market could open up for a drop towards the 0.76 level. The 0.76 level extends down to the 0.75 level, which for me is a major support level of interest. If we can break down below the 200-day EMA, then it is likely that we could start to see selling pressure start to take off. I do not see that happening anytime soon, but at this point it is likely that we will see buyers coming into pick up any dip anyway. The Australian dollar continues to get a boost from commodity markets, and I think that is the theme going forward.