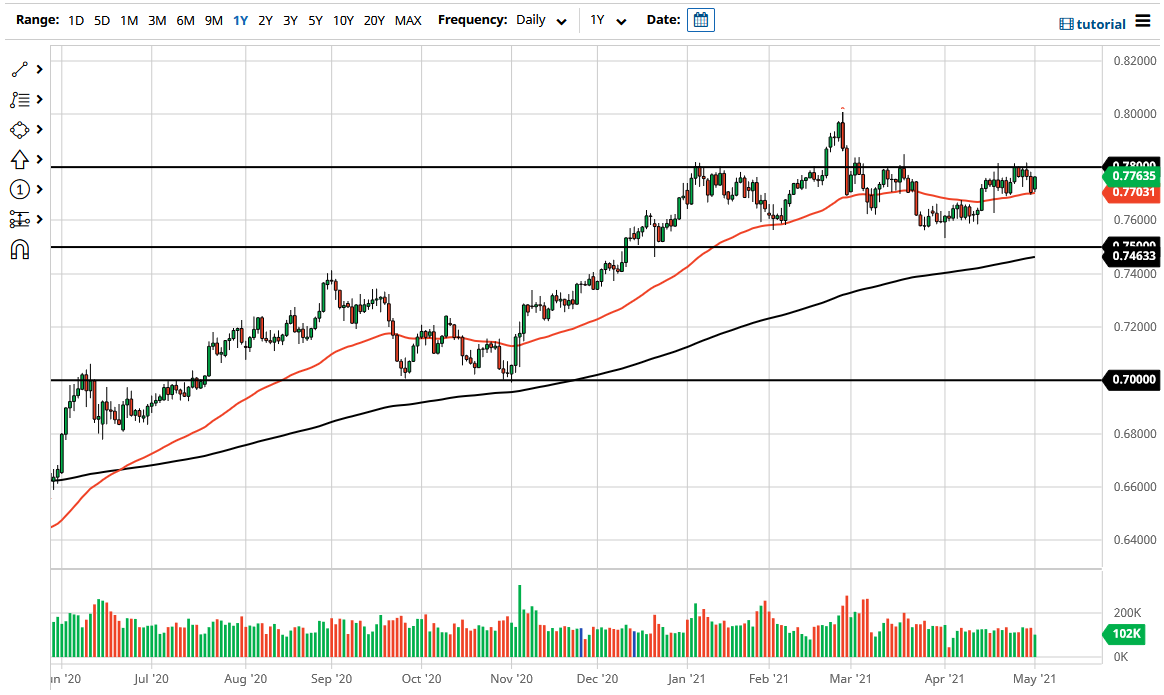

The Australian dollar rallied a bit during the trading session on Thursday yet again, bouncing from the 50-day EMA yet again as well. The 0.78 level above is resistance that has been difficult to break, so it is likely that we will continue to see a big fight on our hands. If we can break above the 0.70 level, then it opens up the possibility of the Australian dollar going higher. In fact, if we do break above the 0.78 level, then it is likely that we will go looking towards the 0.80 level at that point.

At the 0.80 level, there then extends resistance at the 0.81 handle. After that, the market is free and clear to go much higher, perhaps as high as the 0.90 level but most certainly the 0.88 handle. That being said, we have a lot of work to do in order to make that happen, so I think that no matter how bullish the market is, it is going to be choppy. Furthermore, when you look at the longer-term chart, you can see that there are some nasty candlesticks that we are trying to work our way through.

The February candlestick was a massive shooting star, just as the marsh candlestick was very similar. The April candlestick is very similar to the March candlestick, showing just how difficult it is going to be to continue going higher. That being said, I do think that the market is probably going to continue to see a lot of noisy behavior, so I think we will see a lot of back and forth short-term trading opportunities. The market is probably going to stay in a relatively tight consolidation until we can figure out what is going on with the US dollar.

The US dollar continues to be a major driver of where we go next, and it will be interesting to see whether or not we are going to get some type of clear signal that we can take advantage of. The market is likely to see a lot of back and forth until we finally get some type of massive and impulsive candlestick that tells us which direction to be involved in. Right now, this is more or less a short-term range-bound market.