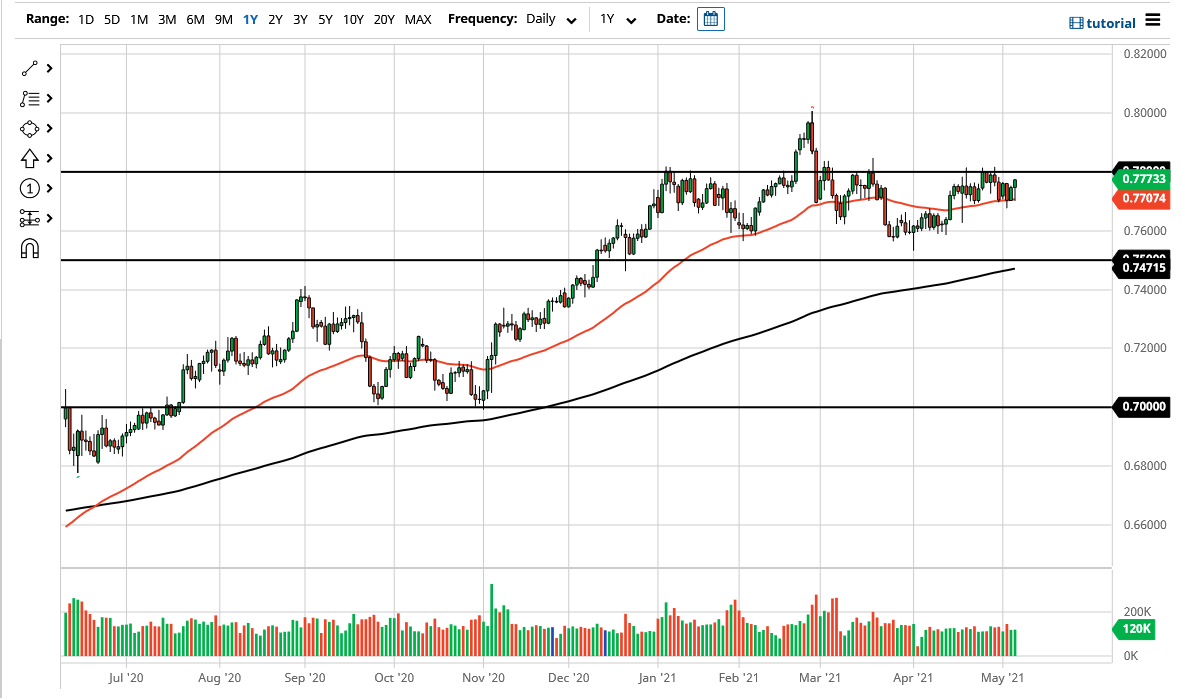

The Australian dollar has fallen initially during the course of the trading session on Thursday but found buyers at the 50 day EMA yet again. It looks pretty strong going into the end of the session, but at the end of the day the 0.78 level continues offer a bit of a massive barrier. The 0.78 level has shown itself to be massive resistance over the last couple of months, but if we were to break above there, then the market is likely to go looking towards the 0.80 level above.

With the jobs number coming out on Friday it does make a certain amount of sense that we would see the Australian dollar hesitate to break out, but the problems that we have had breaking out previously does make the 0.78 level would be a bit too much to overcome during the day on Thursday. Having said that, it is possible that the jobs number could cause the volatility for the breakout, but I would not get overly excited about it until we get a daily close above that handle. Alternately, if we show signs of exhaustion the market is likely to go back down towards the 50 day EMA. If we break down below the 50 day EMA, then it is likely that we go to the 0.76 handle.

What I find interesting about the 0.76 level is that there is a roughly 100 PIP support level that extends down to the 0.75 level which is also attracting the 200 day EMA as we move along. Ultimately, the market has been choppy for a while and the fact that the Chinese and the Australians continue to argue probably does not help the situation either.

Pay close attention to the US dollar in general because it will obviously have an effect on this pair. The Australian dollar is highly levered to commodities, so that of course helps the market moving forward as well, so it will be interesting to see how this plays out after the jobs figure. All things being equal, it does look bullish longer term, but right now we are simply going sideways, perhaps trying to work off the excess froth from the shot higher we had earlier this year. I anticipate that this will continue to be very noisy, but if we can finally get that daily close above zero and 70, the market will finally show some clarity to the upside.