Bullish View

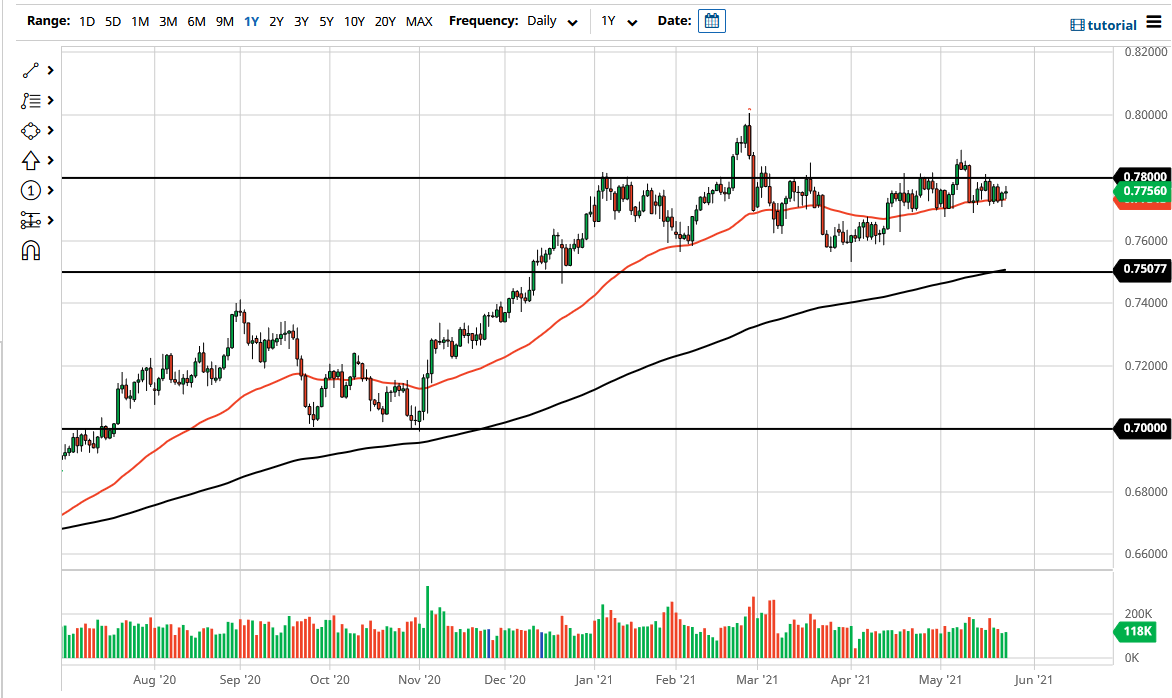

- Buy the AUD/USD and add a take-profit at 0.7815 (May 18 high).

- Add a stop-loss at 0.7740.

- Timeline: 1 day.

Bearish View

- Set a sell-stop at 0.7750 and a take-profit at 0.7700.

- Add a stop-loss at 0.7800.

The AUD/USD rose in early trading as traders reacted to the latest interest rate decision from New Zealand and the strong house prices data from the United States. It rose to 0.7777, which was almost 1% higher than its lowest level this week.

Clues from New Zealand

The AUD/USD pair rose after the Reserve Bank of New Zealand (RBNZ) delivered its interest rate decision. As was widely expected, the bank left interest rates and its quantitative easing policies unchanged. At the same time, the bank provided hints that it would hike interest rates in the coming year since the recovery has been relatively stronger than expected.

The Australian dollar rose also because of the close relations between the two countries. Market participants believe that the Reserve Bank of Australia (RBA) will turn hawkish as well.

The AUD/USD also rose after the positive economic data from Australia. The data revealed that the construction work done in the first quarter rose by 2.4% after it fell by 0.9% in the previous quarter. This increase was significantly better than the median estimate of 2.2%. The number implies that the country’s housing sector is strong, helped by the relatively low-interest rates. Tomorrow, the country’s statistics agency will publish the latest building expenditure data for the first quarter.

The pair is also reacting to the latest home price data from the United States. The numbers showed that home prices rose by 13.2% in April after rising by 12% in the previous month. This was the fastest monthly growth since 2005. This growth was attributed to low-interest rates and the recent surge in material prices. Indeed, raw materials like lumber have seen their prices more than tripled in the past 12 months.

AUD/USD Technical Forecast

The AUD/USD pair rose to a high of 0.777. On the four-hour chart, the pair is above the ascending trendline that connects the lowest levels on May 4, 13, and 24. It has also moved above the 25-day and 15-day exponential moving averages (EMA)) and is approaching the important resistance at 0.7813. The pair also seems to be forming a head and shoulders pattern, which is usually a bearish signal. Also, it seems to be attempting to move above the important resistance at 0.7780. Therefore, in the near term, the pair will likely keep rising as bulls target the next key resistance at 0.7813. Any move above that level will invalidate the H&S pattern.