Last Tuesday’s AUD/USD signals were not triggered, as the bearish price action cut cleanly through every identified support level which was reached.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered prior to 5pm Tokyo time Friday.

Short Trade Ideas

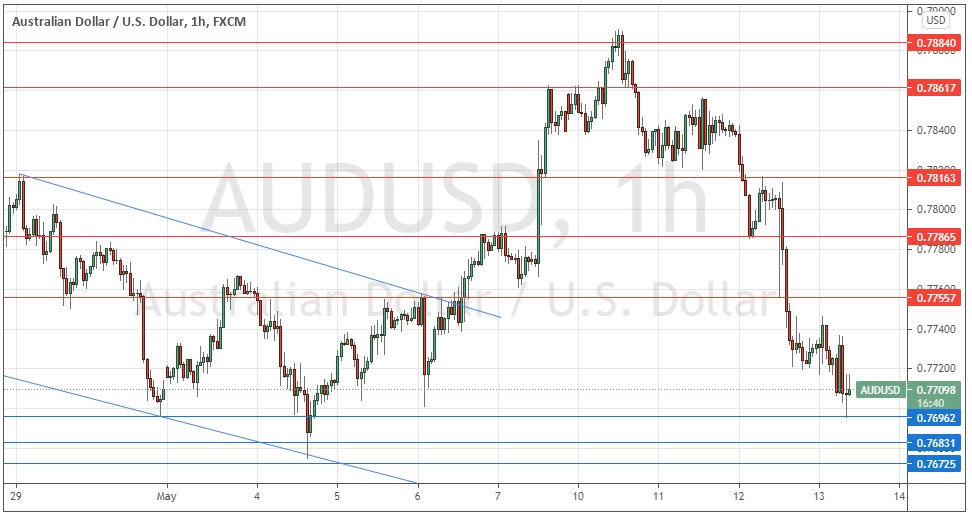

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7756 or 0.7787.

- Put the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7696, 0.7683, or 0.7673.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that the technical picture remained bullish if the price held up above 0.7816.

Due to U.S. dollar weakness, I saw this currency pair as remaining a good buy from any bullish bounce at 0.7816.

The market environment changed quickly, and the price quickly broke below 0.7816 support level and kept falling strongly. I was not looking for this.

Fear of resurgent inflation, especially in the U.S., has triggered risk-off sentiment in the market which has sent this pair moving strongly downwards as a key risk barometer. This sentiment was reinforced by yesterday’s U.S. inflation data which came in at a 25-year high – an annualized rate of 3%.

Although there is every sign that this sentiment will persist for at least a few more days, the price chart below shows the price has fallen to begin to stabilize at a cluster of support levels which begin at 0.7696. Therefore, I think the price today will be likely to consolidate just above this zone or even rise slightly. Yet a short trade from a bearish reversal at resistance remains a good trade here if it sets up.

A strong bearish sign would be if the price falls further today and ends up below the support level at 0.7673, but I think that this is unlikely to happen.

There will be a release of U.S. unemployment claims data at 1:30pm London time. There is nothing of high importance scheduled concerning the AUD.