Bearish View

- Set a sell-stop at 0.7700 and a take-profit 0.7612 (78.6% Fibonacci retracement).

- Add a stop-loss at 0.7760.

- Timeline: 1-2 days.

Bullish View

- Set a buy stop at 0.7740 and a take-profit at 0.7850.

- Add a stop-loss at 0.7670.

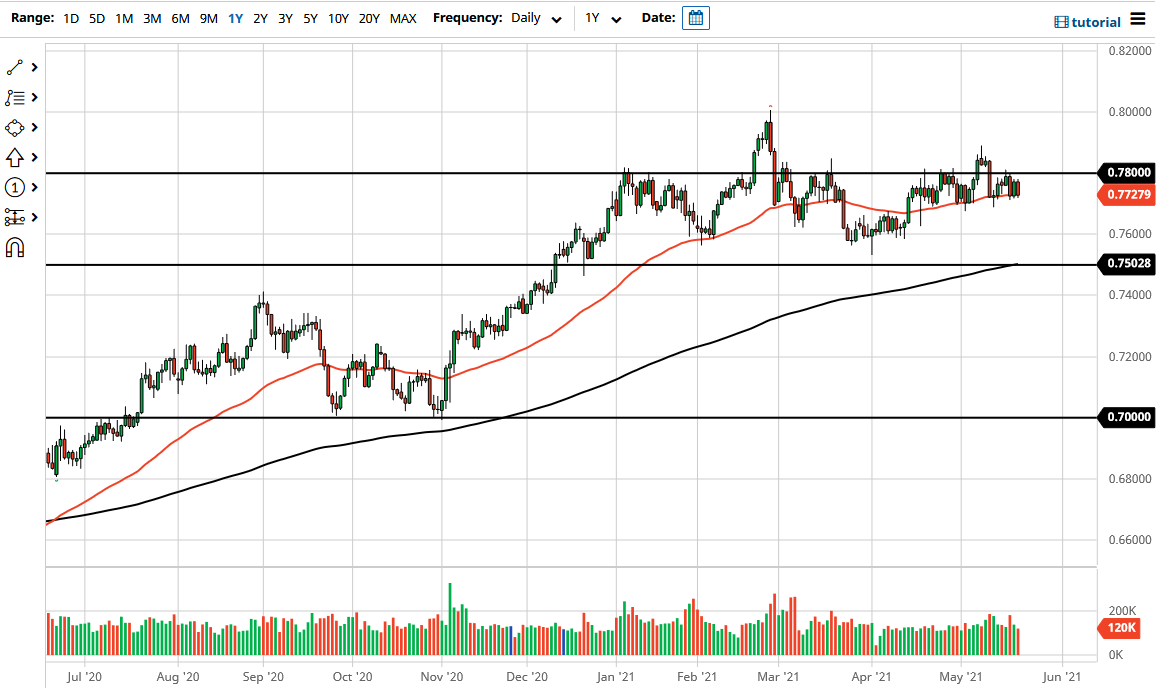

The AUD/USD retreated today as the US dollar sell-off gained steam. The pair dropped to 0.7700, which was the lowest level in almost two weeks.

Calm Week for Australian Traders

This will be a calm week for Australian traders since there will be no major economic data from the country. The Australian Bureau of Statistics (ABS) has already published relatively strong inflation, retail sales and trade data from the country. On Friday, data by Markit revealed that the country’s Manufacturing and Services PMIs made a modest recovery in May. The Australian dollar will be affected mostly by the overall prices of commodities.

The AUD/USD will react to data from the United States and the performance of the dollar. The US Dollar Index has dropped by more than 0.15% as investors keep worrying about inflation and the potential for high interest rates. Recently, data showed that the American Consumer Price Index (CPI) rose by 4.2% in April this year while core CPI rose by 2.3%. These were the highest readings in years and were above the FOMC target.

Later this week, the US is expected to publish the relatively strong personal consumption expenditure (PCE) data. Analysts surveyed by Bloomberg expect the data to show that the headline PCE index rose by 3.8% in April this year. That will be the highest reading since 2008.

The AUD/USD will also react to the ongoing debate on US infrastructure. Last week, Joe Biden decided to narrow down his proposal from more than $2.3 trillion to $1.7 trillion in order to gain Republican support. Republicans, on the other hand, have proposed a narrower infrastructure package that is unlikely to get the support of Democrats. Such a package will help boost inflation and commodity prices. The AUD/USD will also be affected by the second reading of the US GDP data.

AUD/USD Forecast

The three-hour chart shows that the AUD/USD pair declined below the important ascending trendline that is shown in black. The pair has also formed a head and shoulders pattern, which is usually a bearish signal. It has also moved below the 25-day and 15-day exponential moving averages (EMA). The two lines of the MACD indicator have moved below the neutral line. Therefore, the pair may keep falling as bears target the 61.8% Fibonacci retracement level at 0.7615.