Bitcoin markets got hammered during the trading session on Thursday as Elon Musk has reversed previous acceptance of Bitcoin as payment for Tesla automobiles. His reasoning is that the energy consumed in the carbon footprint of Bitcoin mining is something that he cannot overlook, although it should be noted that Tesla still holds quite a bit of Bitcoin in their own wallet. In other words, this is probably a short-term pullback but it was probably needed regardless.

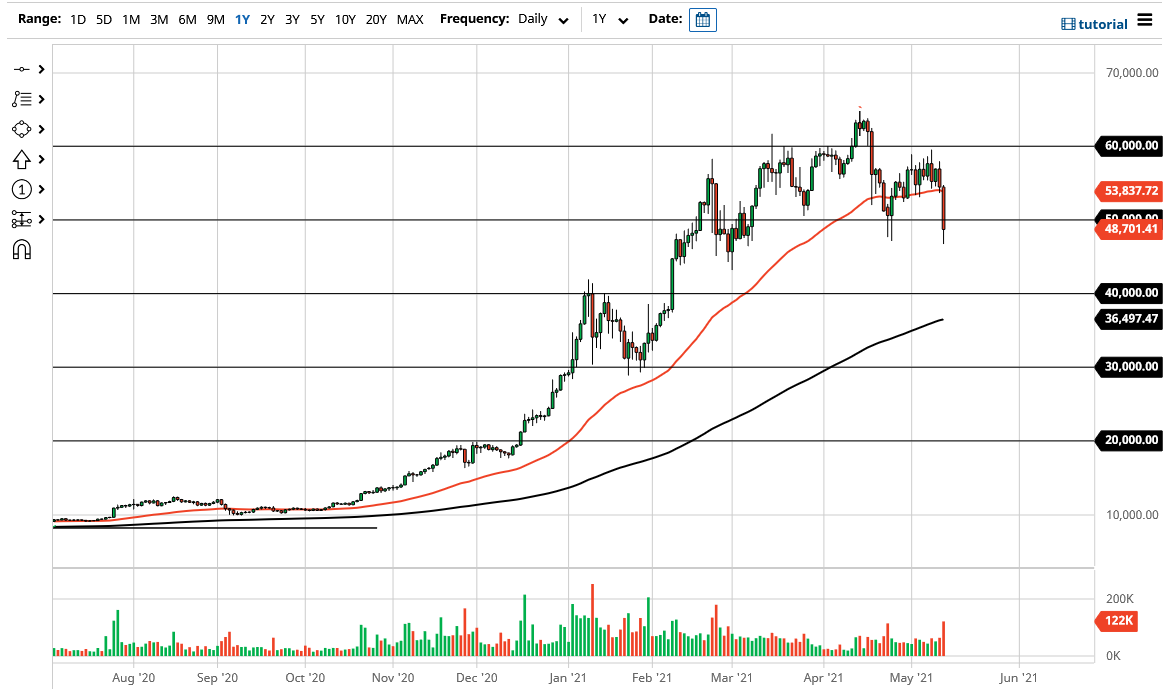

The $50,000 level is sitting at the bottom of the overall range that we have been in, but it should be noted that we are closing at the very low of the range which is quite a bit more bearish than some of the other attempts to pull back that have happened recently. It is because of this that I would not be surprised at all to see this market break down below the bottom of this candlestick and perhaps go looking towards the $40,000 level underneath. The $45,000 level of course is an area between here and there that could come into play as well, as it has been supportive in the past.

Either way, I think it is only a matter of time before we get value hunters coming back into the marketplace to pick the market back up, but I do not think that there is a significant rush to get back into the market right away. Ultimately, I believe that Bitcoin will find plenty of buyers, so I am waiting for a stabilizing candlestick on the daily timeframe to get long again. I think it is only a matter of time before the overall trend continues, because of course there is a significant amount of institutional money getting involved in this market.

Furthermore, we will have to pay close attention to the US dollar because if it gets hammered, it is very likely that could translate into higher crypto pricing as well. The fact that Elon Musk made this statement and the market sold off tells me that this is probably a short-term noisy event more than anything else. With that in mind, I do not have any interest in shorting, as we are well above the 200 day moving average which a lot of traders will use as a trend defining indicator.