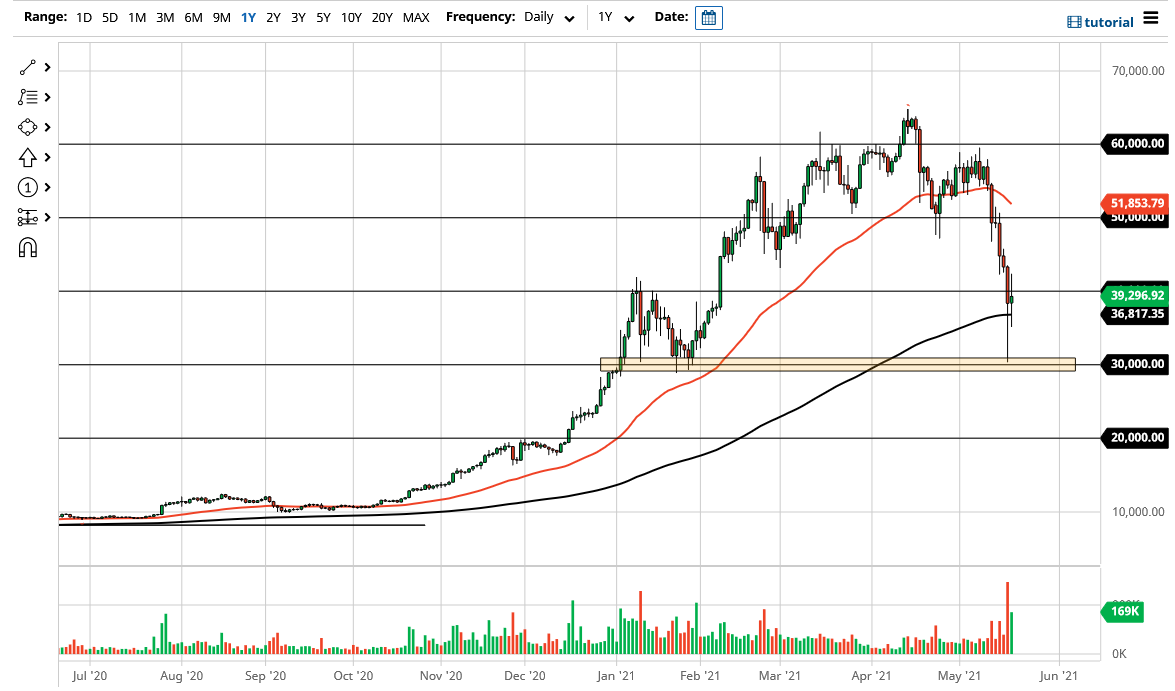

Bitcoin markets were a bit choppy during the trading session on Thursday as Janet Yellen suggested that perhaps more stringent IRS actions may be needed against crypto markets, and the buying and selling of those assets. Nonetheless, I think the most important thing to pay attention to is that this is a bit of an inside candle compared to the massive candlestick that we had seen during the previous session, so this tells me that at the very least we are starting to calm down a bit.

After that massive selloff during the session on Wednesday, the action that we have seen during the day on Thursday is a very good sign, as at the very least it suggests that the market is trying to quiet down a bit. The 200 day seems to be holding, as the technical traders out there will have looked at it as a very important signal. Furthermore, the $40,000 level is right in the same neighborhood, so it is a bit of a magnet for price as far as we have seen of the last couple of days.

During the Wednesday session, the market broke down towards the $30,000 level in a massive liquidity event that may have been kicked off in the options markets. At this point, the market broke down towards the $30,000 level before bouncing significantly. Because of this, I think that there is a certain amount of buying pressure in that area, and it certainly looks like it structurally important. While a lot of people are celebrating the fact that Bitcoin stayed somewhat still for the session, the reality is that volume for the trading session on Thursday was much less than Wednesday, so I suspect that we at the very least have a certain amount of work to do before we can hold the uptrend.

On the other hand, the market broke down below the $30,000 level, then we could go looking towards the $20,000 level. Bitcoin and the rest of the crypto market got far ahead of itself recently, so it should not be a huge surprise that we have seen this type of massive selloff. Because of this, the market should continue to keep some of the “weak hands” to the sideline, but really at this point what you need to see is several days of consolidation. I suspect we probably still have the possibility of another move lower.