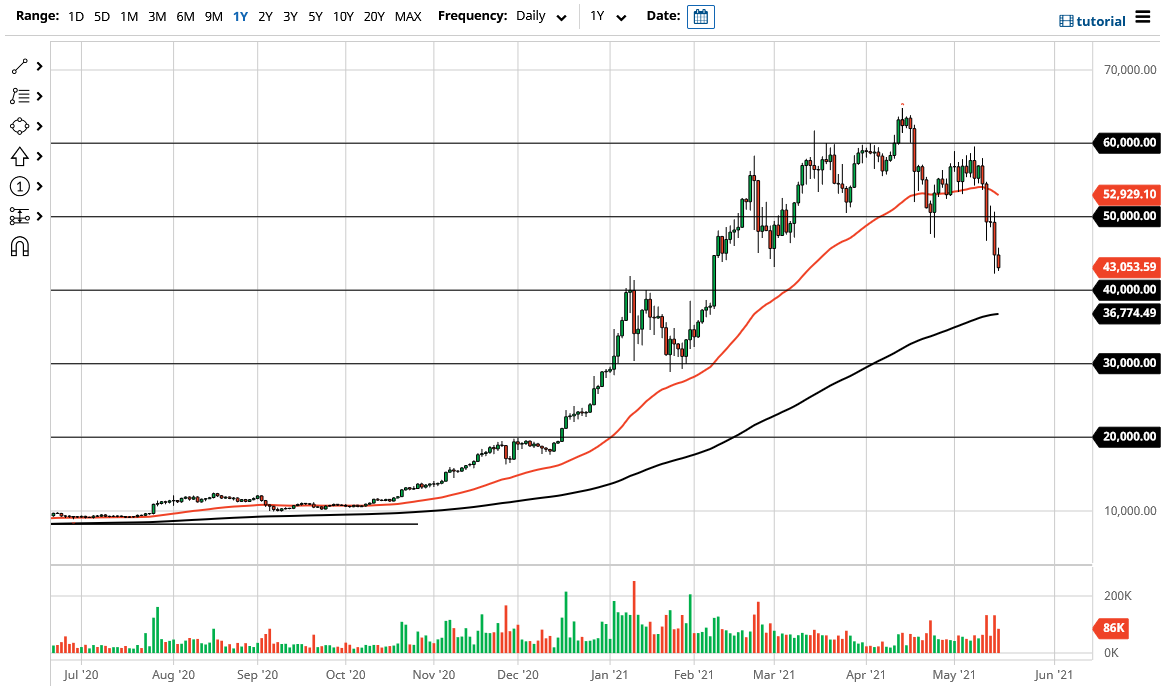

Bitcoin markets initially tried to rally on Monday but then found the $50,000 level to be a bit too much to overcome. After that, the market then broke down below the lows of last week, an area near the $48,000 level that had been supported for some time.

At this point, there are a lot of questions as to what caused this, but at the end of the day it really does not matter, although a lot of people are trying to pin this on the fact that Elon Musk flip-flopped on his opinion when it comes to Bitcoin over the weekend. The reality is that the market got way ahead of itself, and it has desperately needed some type of pullback to offer value. I have been suggesting for a while now that we could pull back towards the $40,000 level, and now it looks like that is probably a foregone conclusion.

What I find particularly interesting is the fact that the 200-day EMA is starting to reach towards that level, and Bitcoin tends to be very sensitive to technical analysis anyway. Perhaps this is because so many retail traders have been involved in it in the past, or perhaps the fact that it is a very digitized and mathematically driven asset that it just lends itself to pay close attention to technical analysis. Regardless, we also have the $40,000 level as psychological support and an area that has mattered in the past. It is because of this that I think there will be a certain amount of buying in this area, especially as institutional interest has suddenly spike in the crypto markets.

I would not jump into this market, because it is not “cheap.” It is falling, and there is a huge difference. In fact, what you need to see is a bit of stability and then a continuation of the uptrend to start getting long, so that is essentially how I would play this. I have no interest whatsoever in trying to short this market, because just as easily as Elon Musk can smash the price with a Tweet, you can also see somebody do the exact opposite. With that being the case, regardless of which you do, you need to be very slow and steady when it comes to building a position, foregoing jumping “all in” when it comes to Bitcoin when you get these pullbacks.