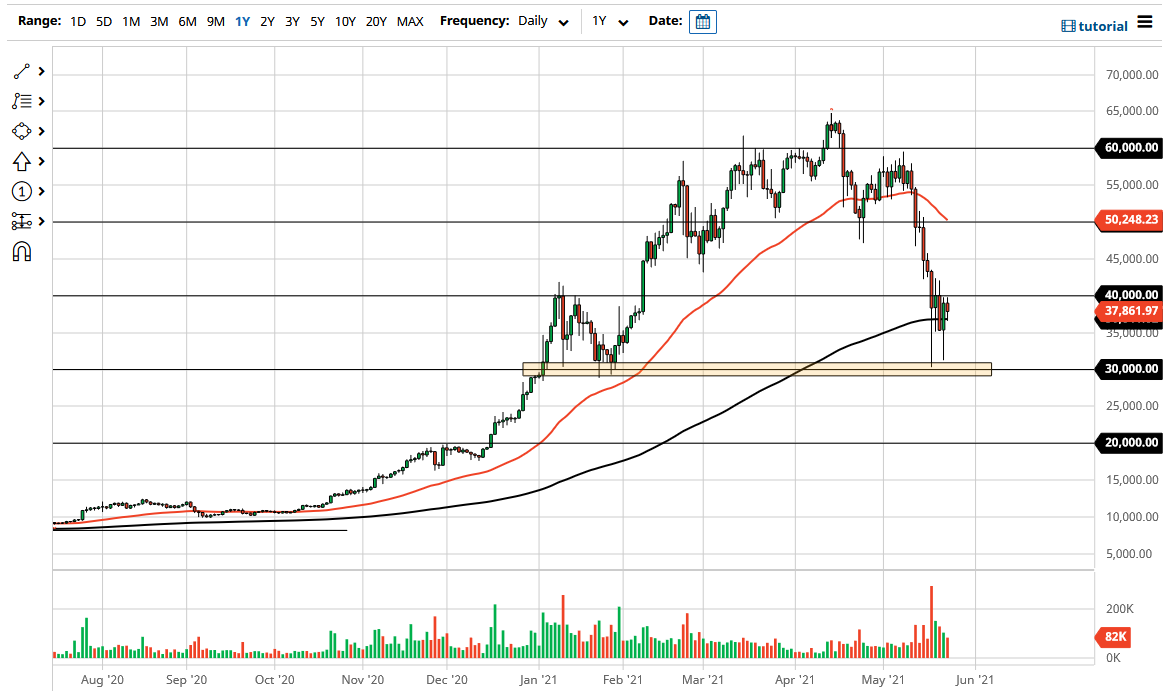

The Bitcoin market went back and forth during the trading session on Tuesday as the market continues to hang around the 200-day EMA. The 200-day EMA is flattening out, so this could suggest that the market is ready to go sideways. We are currently sitting just below the $40,000 level as well, and it should be noted that the $30,000 level underneath needs to hold for traders to be able to take advantage of the pullback and value in this general vicinity, so it will be interesting to see whether or not we can hold on.

If we were to break down below the $30,000 level, then it is possible that the market could go much lower, perhaps down to the $20,000 level. Ultimately, this is a market that I think will continue to see a lot of volatility, but if we can break above the $40,000 level, it is likely that we could go looking towards the $50,000 level as well, as it is the next large, round, psychologically significant figure. That is an area where the 50-day EMA is currently sitting and perhaps trying to cross down below. The 50-day EMA will attract a certain amount of attention by technical traders, which could cause a bit of noise.

The area that we are currently trading in right now is what I would look at as consolidation, as we need to see some type of momentum get back into this market to put serious money to work. However, if you are a longer-term trader, then you are likely to look at this as just an area to pick up a little bit of value. Obviously, you cannot jump in with both feet, because if it breaks down below the $30,000 level, we could fall much further. At that point, the $20,000 level would also be an area to watch. If we break down below there, then we could see a massive sell-off. I do not think that will happen, though, because unlike the last time we got crushed in this market, there are plenty of institutional investors out there looking to buy the dip given enough time.