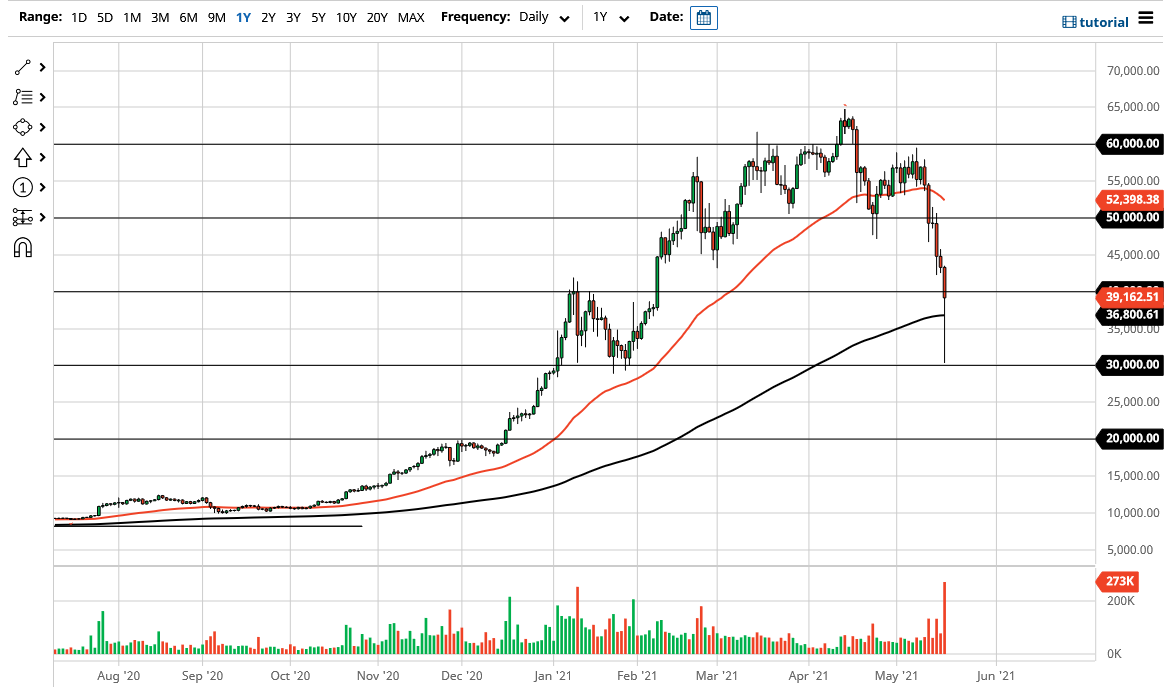

From what I understand, most of the move during the trading session on Wednesday was due to massive amounts of liquidation of levered positions in the Bitcoin market, as some traders had gotten far ahead of themselves. That led to more selling, and Bitcoin dropped as low as 30,000 rather quickly before bouncing back above the 200-day EMA.

If you have been following my analyses here, I suggested that if we can break down below the $40,000 level, then we would see the 200-day EMA come into the picture, followed by the $30,000 level. (I am the first person to admit that I did not see this happening in a matter of a few hours, but I digress.) Now that we have fulfilled that move, the question is whether or not we can turn around and rally for any significant amount of time.

If you have been trading crypto for any amount of time, you know that pretty much anything is possible. I suppose it is worth noting that the candlestick is somewhat of a hammer, but at the end of the day it is still a rather ugly-looking move, especially as we were at $55,000 just a week ago. The fact that Bitcoin found buyers at $30,000 is less a function of confidence and more a function of short-sellers taking profit, and perhaps some of that is highly levered longs finally getting out of the way. The market has been far ahead of itself for quite some time, so to kick off selling and work out some of the froth the way we have is not necessarily something that I would be overly surprised by. The ferocity, and perhaps even more importantly, the volume is something that is worth paying attention to.

It is through this prism that I suspect there is probably more selling to come, but quite a bit of the negativity is out of the way. I believe at this point the best thing to do is simply sit on the sidelines and wait for a couple of days of stability before getting involved. If you are a longer-term “buy-and-hold” type of investor, then it is possible that this could be an opportunity, but I think you have plenty of time.