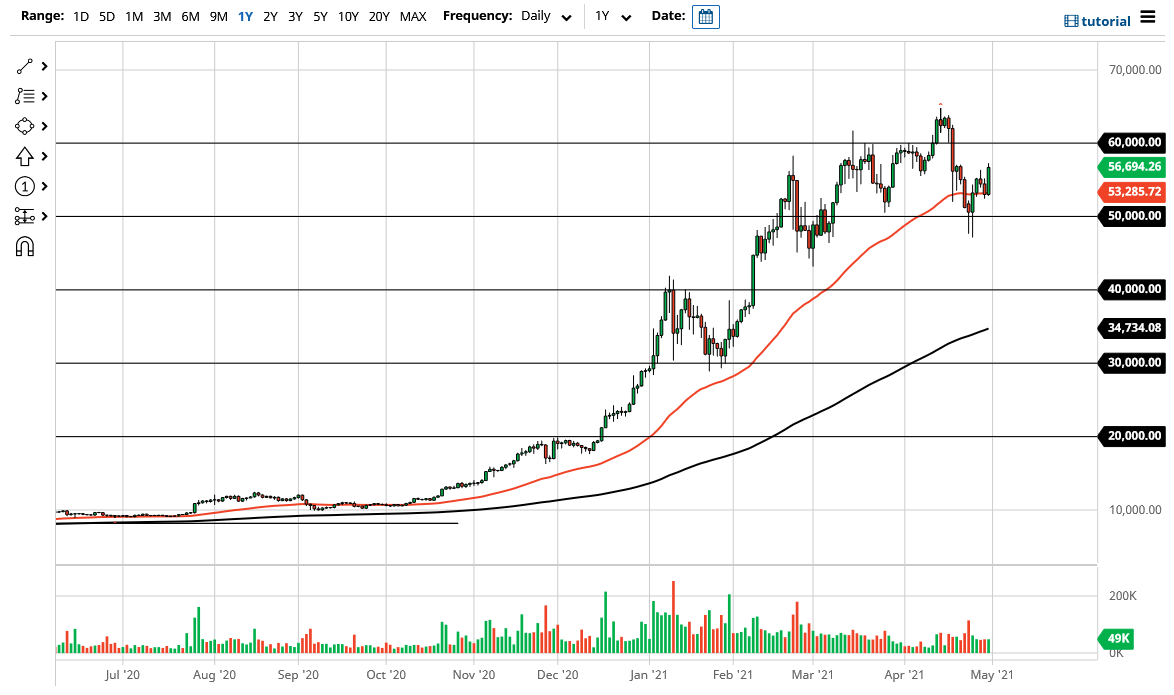

The Bitcoin market bounced rather hard during the trading session on Friday as the 50-day EMA has offered support. Therefore, it looks like the market is ready to continue grinding to the upside, perhaps reaching towards the $60,000 level. The $60,000 level above is a large, round, psychologically significant figure, and an area that I think short-term traders will be targeting. If we can break above there, then the market is likely to continue going higher, reaching towards the $65,000 level next.

Underneath, the 50-day EMA offers support, just as the $50,000 level would. Furthermore, we have a couple of hammers down there that suggest that we are going to see buyers there as well, so it should be a short-term floor in the market. At this point, the market is probably going to continue to look at that as a major support level, and the fact that we have bounced the way we have during the Friday session also suggests that we are ready to go higher.

Bitcoin had taken a significant pullback, but that something that we needed to see in order to build up momentum. While retail traders look at Bitcoin and suggest that the price is too expensive to get involved in, institutions are pouring money into the market. That being said, it is very likely that there will be a “buy on the dip” mentality going forward, and that is how you should look at this market. It has been in an uptrend and there is no reason to think that that is going to change anytime soon. Because of this, I have no plans on selling, but if we were to break down below those couple of hammers, I think that the Bitcoin market could go looking towards the $40,000 level, especially if the 200-day EMA gets pierced to the downside. That could open up a massive selling frenzy, but right now it is going to be different than the last time we saw a bit of a bubble, because there is a significant amount of institutional money out there willing to get involved. With this, I remain bullish, but I also recognize you need to be very cautious, especially if you are levered with your broker. Currently, I do think that we will go looking towards the highs.