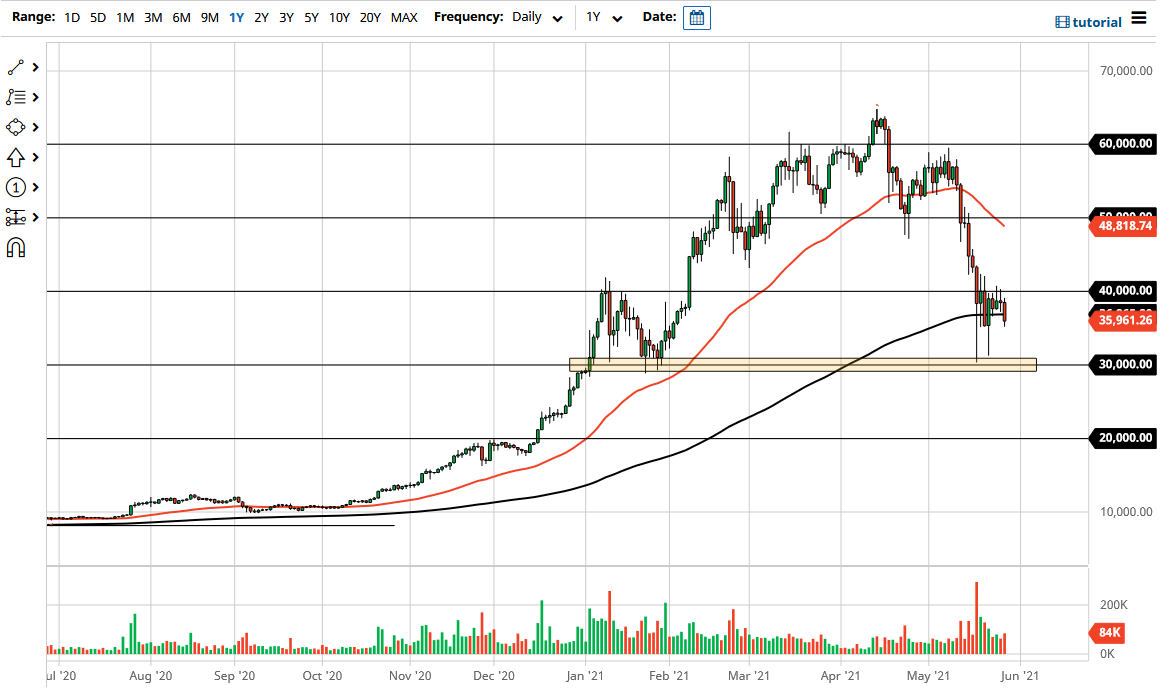

The Bitcoin market fell a bit during the trading session on Friday to pierce below the 200-day EMA. At this point, it looks as if we are testing the $35,000 level, but this is a somewhat minor support level. I think that breaking down below here and retesting $30,000 is a very real threat over the Memorial Day holiday weekend. Because of this, I think that the overall look at this market is bearish, but the 200-day EMA has attracted enough attention that I think we are at least going to be asking some questions.

The $30,000 level underneath would be massive support and, if we were to break down below there, it could open up a bit of “trapdoor action”, as the market would break down towards the $20,000 level. After all, that was an area that has been important in the past and would almost certainly work off a massive amount of froth in a market that had gotten far too ahead of itself.

A lot has been made of the institutional adoption of Bitcoin and a lot of the institutional investors getting involved. As time goes on, it is becoming more obvious that the institutional buyers are much smaller in number than people had initially thought. This makes sense, because we were in the midst of watching the market shoot straight up in the air. Now that we have pulled back, we are getting closer to a point where a lot of “smart money” might be interested in getting involved. After all, they buy value and dump off the asset once it gets a bit too expensive, something that we most certainly have seen lately.

If we were to turn around and break above the $40,000 level on a daily close, that might be a good sign that we are going higher. If that happens, then I think the market is very likely to go looking towards the $50,000 level. I do not necessarily think that is going to be the case, though, so with that being said, I look at it as a potential setup, but not the main one that I am expecting. It is very possible that we could see simple consolidation in the $10,000 range right now, as we are trying to get our footing.