Bullish View

- Set a buy stop order at 40,000 and a take-profit at 42,000.

- Add a stop-loss at 38,000.

- Timeline: 1 day.

Bearish View

- Set a sell-stop trade at 35,000 and a take-profit at 30,000.

- Add a stop-loss at 40,000.

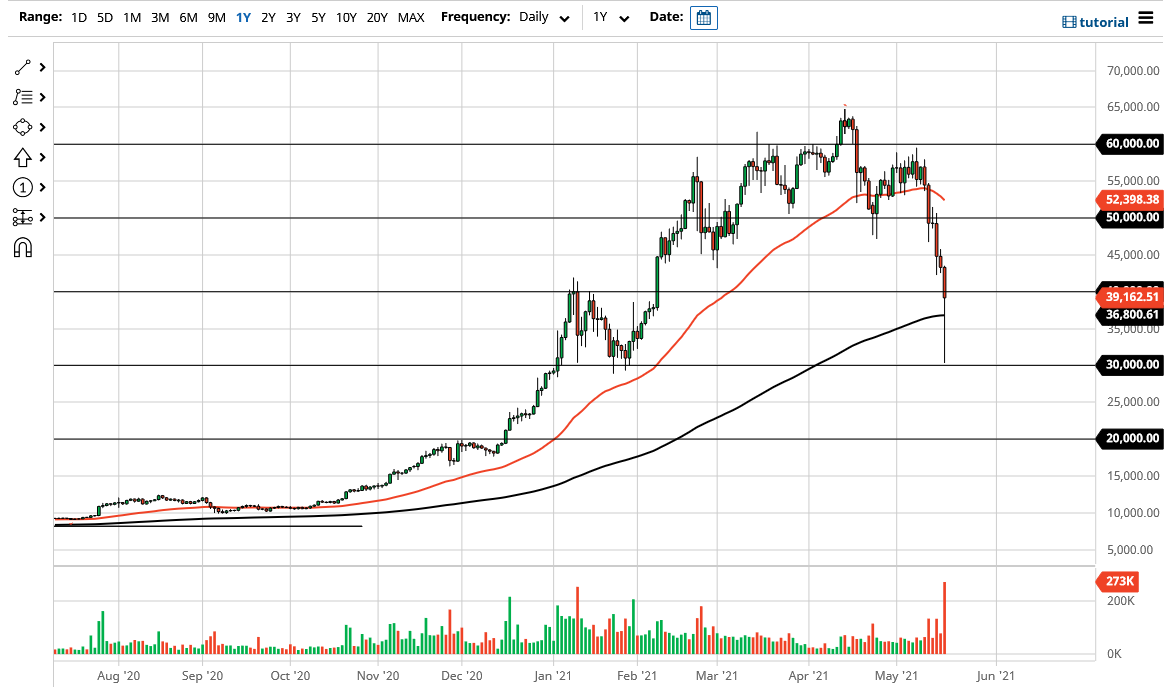

The BTC/USD sell-off accelerated as worries of more regulations in China continued. The pair declined to 30,000, which is substantially lower than the all-time high of near 65,000. The coin’s market cap has dropped to $710 billion, down from more than $1 trillion a few weeks ago.

China Regulatory Fears

There are several reasons why the BTC/USD has retreated in the past few sessions. First, there are fears that the Federal Reserve will start tightening its policies since the US economy is showing signs of improving. In the minutes published on Wednesday, some members of the FOMC signaled their willingness to start tapering asset purchases.

At first, this could have a negative impact on cryptocurrencies and other assets. In fact, as Bitcoin prices dropped, other assets like indices and commodities also fell. However, historically, investors tend to adapt easily when the Fed starts a tightening phase.

The BTC/USD also declined after the People’s Bank of China (PBOC) warned companies against accepting the currency. The central bank and other regulators also warned financial companies like banks that accept the currencies. In general, cryptocurrencies that guarantee anonymity are risky for the Chinese government, which likes to surveil its citizens.

Further, there are concerns about the impact of Bitcoin mining on the environment. Environmentalists have long complained that the proof-of-work framework consumes too much fossil fuels. As such, many large investors who are shifting to ESG investments might stay away from Bitcoin and companies that invest in it. Last week, Elon Musk cited the environment as the reason why Tesla stopped accepting the currency.

The BTC/USD has also declined because of tax reasons. As part of his infrastructure proposal, Biden has proposed increasing the capital gains taxes. Therefore, many cryptocurrency holders in the country have sold their holdings to avoid these taxes.

BTC/USD Technical Outlook

The four-hour chart shows that the BTC/USD pair fell to 30,000 and then quickly bounced back to more than 38,000. This happened as some traders rushed to buy the dip after Tesla said that it will not sell its Bitcoin holdings. The price remains below the 25-day and 50-day moving averages. It is also slightly below the important resistance at 47,123, which was the lowest level on April 25. Therefore, the pair may see some bullish moves today as investors buy the dips.