Bullish View

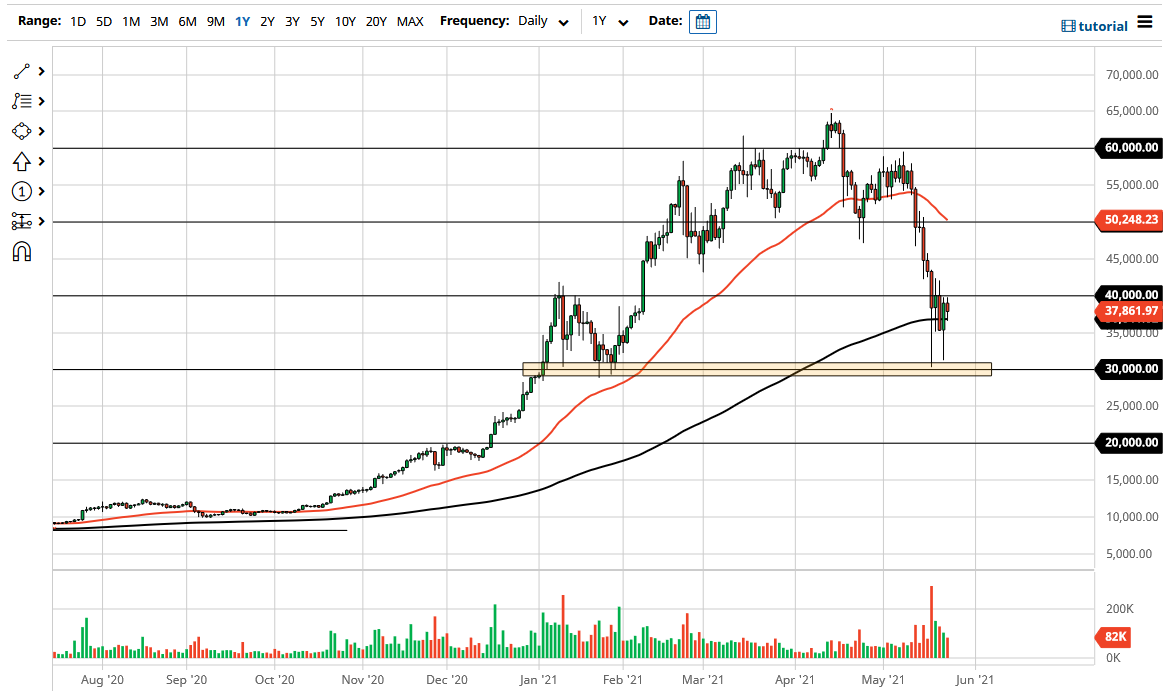

- Set a buy stop at 40,000 and a take-profit at 43,000 (61.8% retracement).

- Add a stop loss at 36,400.

- Timeline: 1-2 days.

Bearish View

- Set a sell-stop at 36,400 and a take-profit at 34,000.

- Add a stop-loss at 38,000.

The BTC/USD tilted higher as investors placed their bets that the Federal Reserve will hold its monetary policy steady even as US consumer inflation rises. Bitcoin is trading at $39,400, which is 31.2% above its lowest level last week.

Bitcoin Bounces Back

Last week, Bitcoin price crashed as investors grew increasingly worried about regulation from China and the potential for high-interest rates as US inflation soared. Tighter regulation is feared because it would affect the demand from one of the biggest markets in the world. It would also incentivize more countries to take a tougher stance on the currency.

High interest rates, on the other hand, is seen as a negative thing for Bitcoin prices because it would lead to a stronger US dollar and tighter market conditions. Investors tend to move from riskier assets to those that are relatively stable in a high-interest rate environment. These fears have eased recently as investors believe that the Federal Reserve will not hike interest rates any time soon. Indeed, the 10-year and 30-year bond yields have dropped to 1.57% and 2.26%, respectively.

The rebound of Bitcoin has also coincided with the resurgence of US tech stocks. In the past few weeks, the NASDAQ 100 Index has dropped substantially as investors worry about interest rates. However, this week, the tech-heavy index has outperformed the Dow Jones and S&P 500.

Bitcoin has also rebounded because of large demand by retail and institutional demand. As the price declined, more investors rushed to buy it at a discount, as evidenced by on-chain data. Also, investors have been encouraged by the fact that many large investors like Tesla and MicroStrategy have not sold their holdings.

BTC/USD Prediction

The four-hour chart shows that the BTC/USD has made a robust recovery after it sank last week. The pair has managed to move above the 78.6% Fibonacci retracement level. It has also moved above the 25-day and 15-day exponential moving averages, in a sign that bulls are gaining momentum. The pair seems to be forming an inverted head and shoulders (H&S) pattern, which is usually a bullish signal.

Therefore, the BTC/USD will likely keep rising as most investors come back. This will likely see it rise to the 61.8% Fibonacci retracement level at 43,174. The momentum will likely gather pace after the pair moves above the resistance at 40,000.