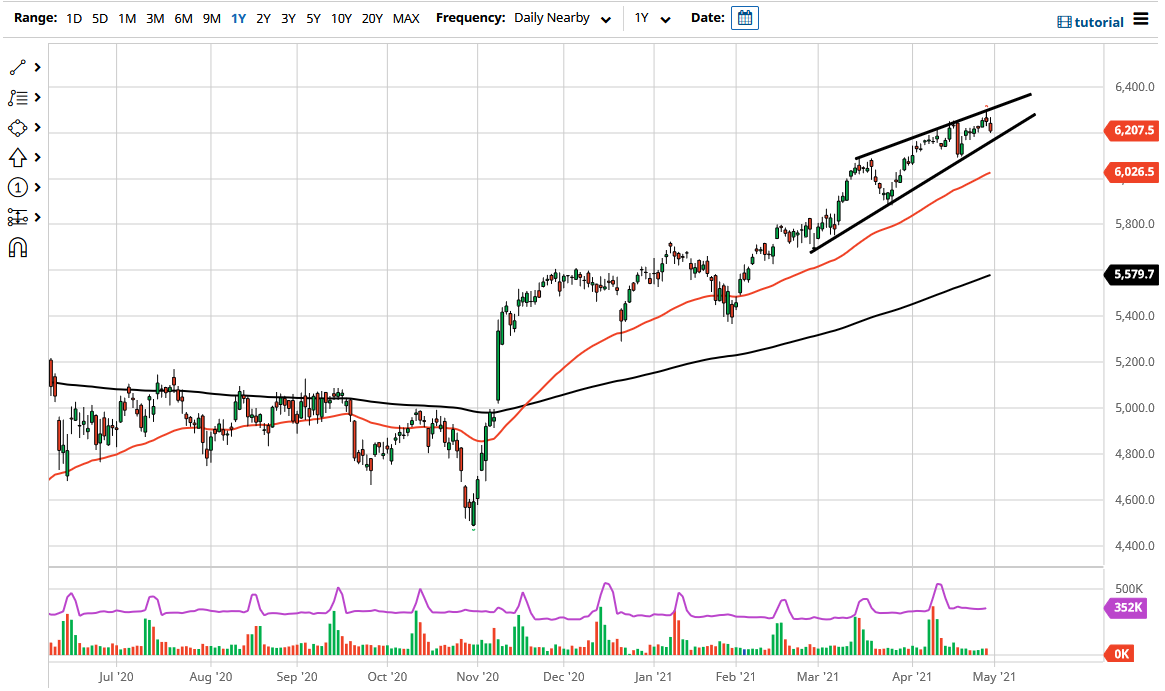

The CAC Index fell a bit during the trading session on Friday, after forming a shooting star from the Thursday session. At this point, the market is likely to continue in this rising wedge that we are forming, so the question now is whether or not we will break down below it. If we do, that could really send this market much lower, perhaps reaching towards the 5800 level. At that point, it is very likely that the 200-day EMA could go looking towards that area as well, so it could be a nice pullback in what has been a strong uptrend.

However, the rising wedge has not been broken down below the bottom, and the market is simply going to use the bottom of this rising wedge as a trendline. We have recently broken above the 6000 level, which is a large, round, psychologically significant figure, and one would have to think that there should be a certain amount of support there, as the 50-day EMA and the psychological aspect come into play. As things stand right now, I believe that stocks in general are very difficult to short, but the CAC may be giving us an opportunity for a breakdown that offers value.

On the other hand, if we were to break above the top of the shooting star from the Thursday session, that opens up the possibility of a move towards the 6400 level, which is my medium-term target. I do believe that the French index will be relatively choppy, because it has to deal with a much narrower list of big movers, and the French economy continues to lag some of the others in the European Union.

I do believe that it is only a matter of time before the buyers takeover, so I do not have any interest in trying to short this market, at least not anytime soon. I do recognize that a pullback is a very real possibility, but I am not willing to short indices, as central banks around the world continue to flood the markets with liquidity, and stocks are very difficult to short. However, if you are a pairs trader, you may choose to short the CAC while buying the DAX to play the differential between the two.