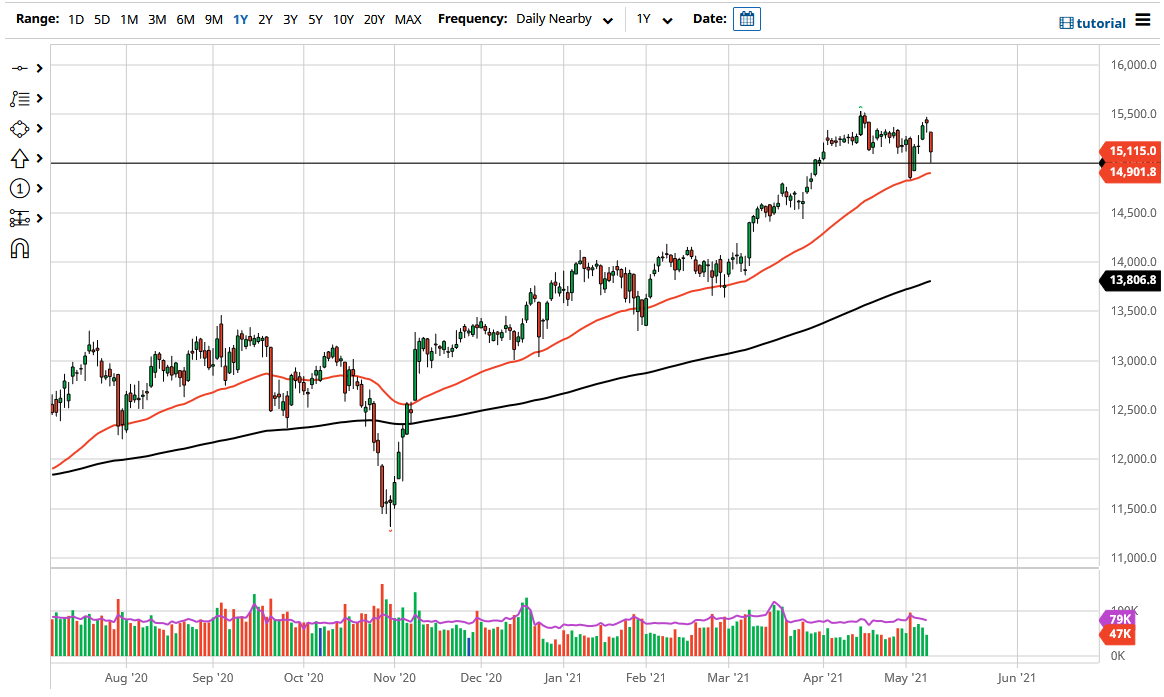

The DAX fell initially during the course of the trading session to reach down towards the 15,000 level, an area that has been important more than once. Obviously, the 15,000 level would attract a lot of attention and that is exactly what happened later in the session on Tuesday. The 50 day EMA is starting to reach towards that area as well, and that comes into play. The 15,000 level is a support level while the 15,500 level above is resistance. We are simply consolidating after a huge move to the upside.

Ultimately, this is a market that gapped lower to kick off the trading session on Tuesday, and that is a gap that needs to be filled. I think if the market turns around it is likely that we will fill that gap and go looking towards the highs above. A break above the 15,500 level allows the market to continue going much higher, and the 16,000 level of course would be the next target as it is a 500 point consolidation area. This is a market that has been bullish for quite some time, and therefore I think what we are looking at is the market trying to work off froth before continuing to go higher.

If we break down below the 50 day EMA, then it is likely the market goes looking towards the 14,500 level. That is an area where we had recently seen support, so I would expect to see it again. If we break down below there, then the DAX goes looking towards the 14,000 level. All things being equal, this is a market that has been bullish for a while, but the occasional pullback should only end up being a buying opportunity. In general, I do not have any interest in trying to short this market as it is a longer-term move. I do like the idea of finding value in a place like the DAX, which of course is widely influenced by the reopening trade as Germany is a major industrial hub for the European Union. This is a market that eventually should go looking towards the highs but will obviously need either a couple of days stabilizing, or some type of catalyst to go long again. In the short term, I think it is noisy but there is no way I would be a seller.