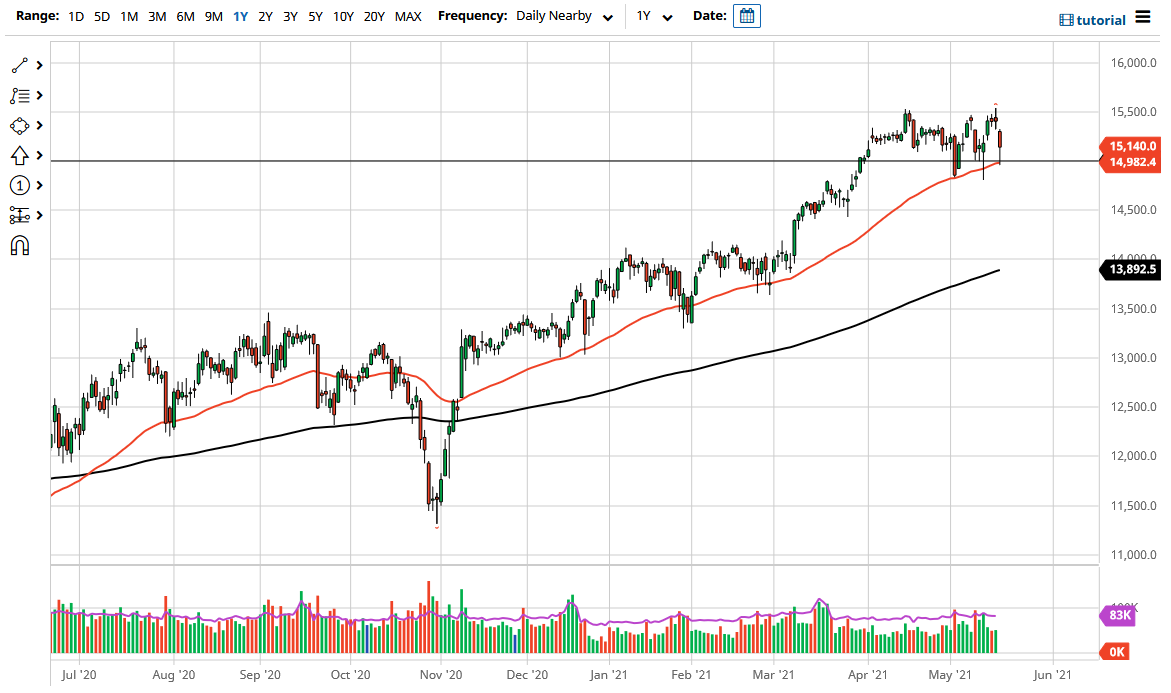

The DAX gapped lower to kick off the trading session on Wednesday to show signs of weakness as risk appetite around the world got absolutely crushed. With that being the case, it is very likely that we continue to hear a lot of noisy behavior, but at the end of the day, the 15,000 level is an area that attracts a lot of attention. Furthermore, we also have the 50-day EMA sitting in that same general vicinity and it is sloping higher, so it is worth noting that we bounced from there.

If we were to break down below the lows of the last couple of weeks, then maybe we will drift down to the 14,500 level, possibly even as low as 14,000 under there. What I find particularly interesting is that the 200-day EMA sits just below the 14,000 level, and I think what we are likely to see is that offer a “floor in the market” if we do get some type of follow-through on the risk aversion that we had seen so much of during the trading session globally.

Remember that the DAX is one of the first places people put money to work as far as stocks are concerned in the European Union, as it is considered to be the “blue-chip index”, with Germany by far the biggest economy in the European Union. This will be especially poignant as traders continue to play the “reopening trade.” The reopening trade is going to feature a lot of industrial demand on bigger companies such as Siemens and BMW, so we should continue to see a lot of strength overall. One thing that did help is that the euro fell, making those exports much cheaper. Nonetheless, the structural significance of the 15,000 level should be worth paying attention to, and it is clear that a lot of traders think the same thing. We have been in an uptrend for a while, but the last six weeks or so have been choppy consolidation more than anything else as we are working off the excess froth. Given enough time, we should eventually take off, but we need to see a daily close above the 15,500 level, which would signify that we will go looking towards 16,000, which is my longer-term target.