The DAX Index initially rallied during the trading session on Tuesday as the German Ifo numbers came out at higher-than-anticipated levels. It is an indication of small business confidence, and that translates into the potential for the German economy to continue growing. Furthermore, the European Union is stepping away from quite a bit of the lockdown measures, so one can think of it as a region that has “a little bit of catching up to do.”

The first place money will go flowing to will be Germany, as it is considered to be the “engine of European growth”; and as a result, it is difficult to bet against the DAX currently. This is despite the fact that we actually had a little bit of a negative day on Tuesday, but when you look at the entire market structure overall, we are certainly still bullish and trying to build up the necessary momentum to clearly break out of the consolidation and go higher.

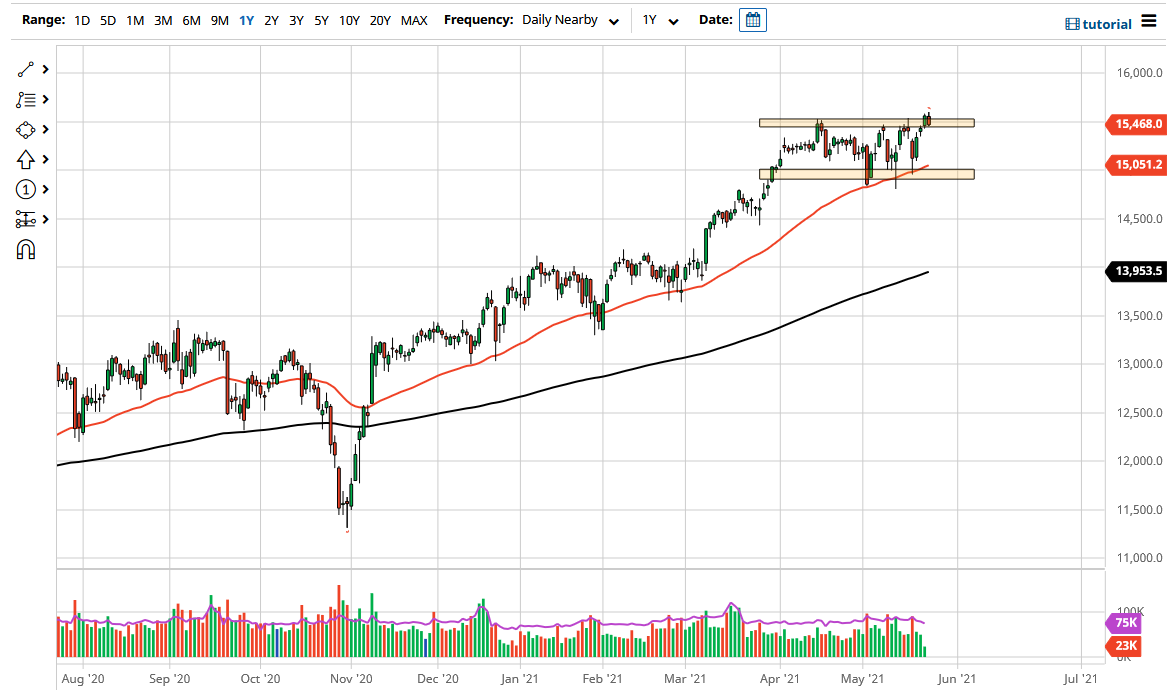

By breaking above the highs of the last couple of days, this opens up a move towards the 16,000 level, which is my next target. I recognize that it will probably be very noisy and choppy in the meantime, but over a long enough time, I believe that the market will find its way to the upside. Furthermore, it is worth noting that the bottom of the consolidation area that I have marked on the chart coincides nicely with the 50-day EMA, which is not only in that area, but it is also ramping higher as far as its angle is concerned, showing a lot of technical support.

With this momentum, one of the things that is helping is the fact that the euro is not necessarily spiking higher. It does tend to rally right along with the DAX, but if it gets a little too far ahead of itself people start to worry about exports. We are nowhere near that, as it has been a very gradual grind higher for the common currency, and that means that we might be in what some analysts and media types referred to as a “Goldilocks situation”, when monetary policy is allowing enough positivity to flow into the markets, but not enough to let them get over-exuberant. I have no interest in shorting; I do believe that the DAX will eventually make a move to the upside and go looking towards the 16,000 handle.