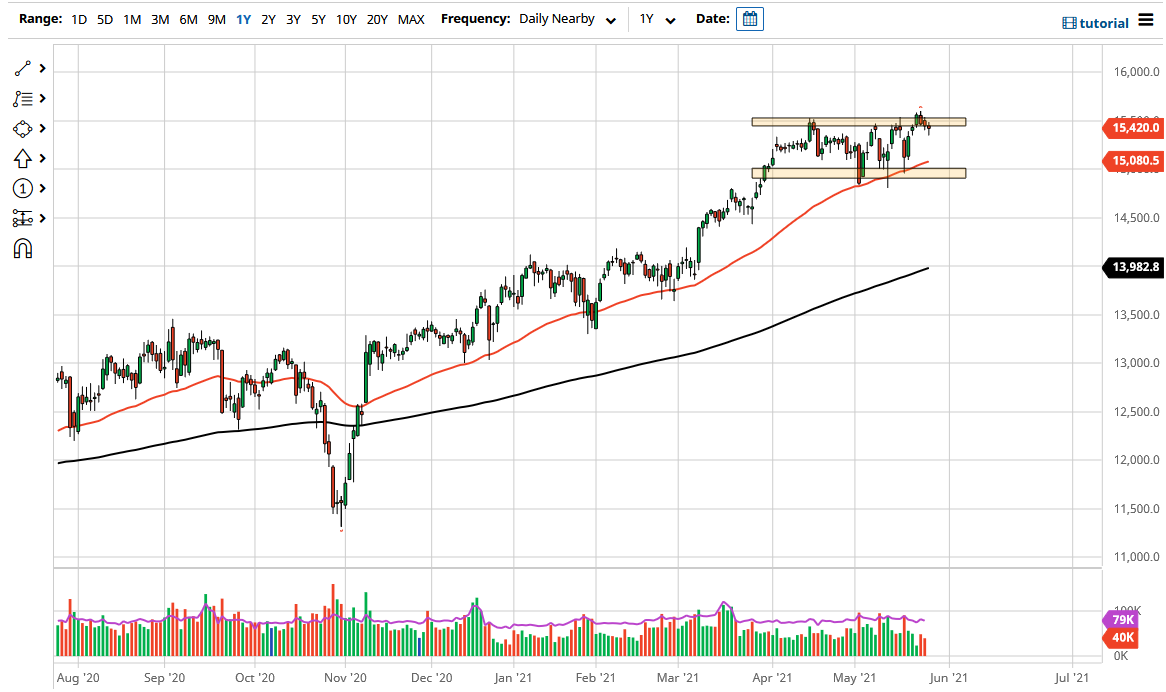

The DAX has pulled back just a bit during the course of the trading session on Thursday but found buyers underneath to pick up pieces of momentum. By forming the hammer that we have, it suggests that there might be more upward pressure here, and a potential break out. By doing so, this suggests that the market could go looking towards the 16,000 handle. This is the “measured move” from the rectangle, as it is roughly 500 points.

The DAX will continue to see a lot of buyers on these dips, as Germany is one of the main economies for the European Union, and of course tends to drive things higher. At this point time, the market is likely to see the 50 day EMA underneath as a potential dynamic support level, so pay close attention to whether or not we pull back and whether or not that holds.

I do not like shorting the DAX, as it is the “blue-chip index” when it comes to the European Union. With this being the case, the market is likely to continue seeing a lot of money flowing into, as the “reopening trade” continues to be the way traders are looking. Ultimately, this is an index that features a lot of exporters, so that is worth paying close attention to. This is a scenario where we could continue to see people jumping in to take advantage of any type of short-term value, but the DAX of course moves right along with the Euro as the currency can be a proxy at times for the DAX as well.

In general, I think that we are going to see a lot of choppy behavior but certainly more of an uptrend momentum type of play. I do believe that the nasty selloff of the last couple of weeks has been short-lived and I think there is some comfort and that considering that the market has bounced hard from the 50 day EMA each time we have tested it. Looking at this market, I just do not see a scenario in which I would be willing to short it anytime soon. In fact, the only way I “short the DAX” is to start buying puts, because of the fact that you can really get hurt if you jump in right away.