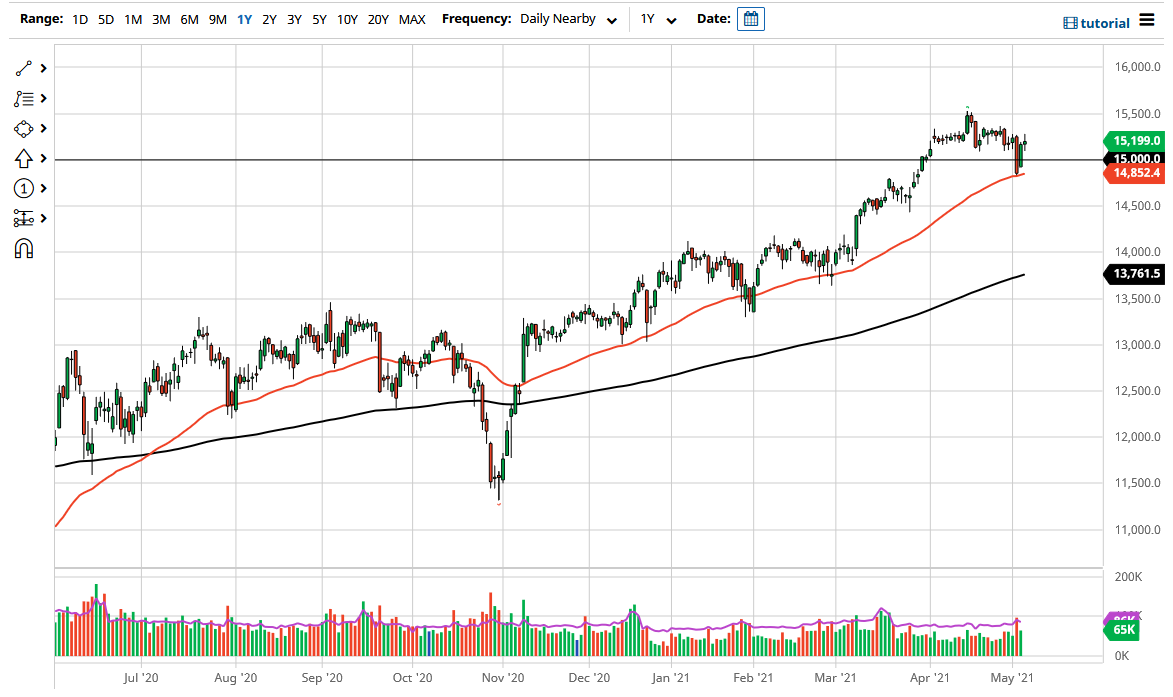

The DAX went back and forth during the trading session on Thursday as we continue to see a lot of sideways volatility. That being said, the market is likely to continue to see a lot of questions about the DAX itself, and at this point in time the 50 day EMA underneath continues offer support. Furthermore, we also have the 15,000 level that comes into the picture, so I think given enough time the buyers will return. We have been in a long-term uptrend, and there is no reason to think that this has changed based upon recent action.

A pullback from here simply attracts more value hunters, and I think that it is only a matter of time before the buyers push towards the 15,500 level. Underneath, even if we were to break down below the 50 day EMA it is likely that we go looking towards the 14,500 level. This is a market that obviously will move with the overall attitude of European equities, and with the “reopening trade” coming back into play, I think Germany will continue to see inflows due to the fact that Germany is such a huge driver of the EU economy in general.

At this point, the market is trying to continue to push to the upside but at this point time, the market will continue to see a lot of inflows as Germany is the first place that people put money to work when thinking about Europe. As for a target, I still believe that the 16,000 level will be targeted, but it is going to take quite a bit of time to get there are more likely than not. There is a lot of noise just above current trading, showing think it takes a minute to get up there, but I certainly would not be a seller.

If we were to break down below the 14,500 level, then I anticipate that the market goes down to the 14,000 handle, which of course is also where the 200 day EMA is racing towards, and therefore it is likely that would be the “floor in the market” for the overall trend. All things being equal, this is a market that I think continues to be more or less a “buy on the dips” scenario, but Friday might be a bit quiet as everybody waits for the job figures out of the US.