The DAX Index went back and forth during the trading session on Wednesday, as we have tested the 15,000 level yet again. Having said that, the market looks as if it is trying to go higher, and the fact that we ended up forming a bit of a neutral candlestick suggests that we have a little bit of hesitation to break down. In fact, when you look at the DAX versus a lot of the other indices that we follow, the DAX performed quite well as it was slightly positive.

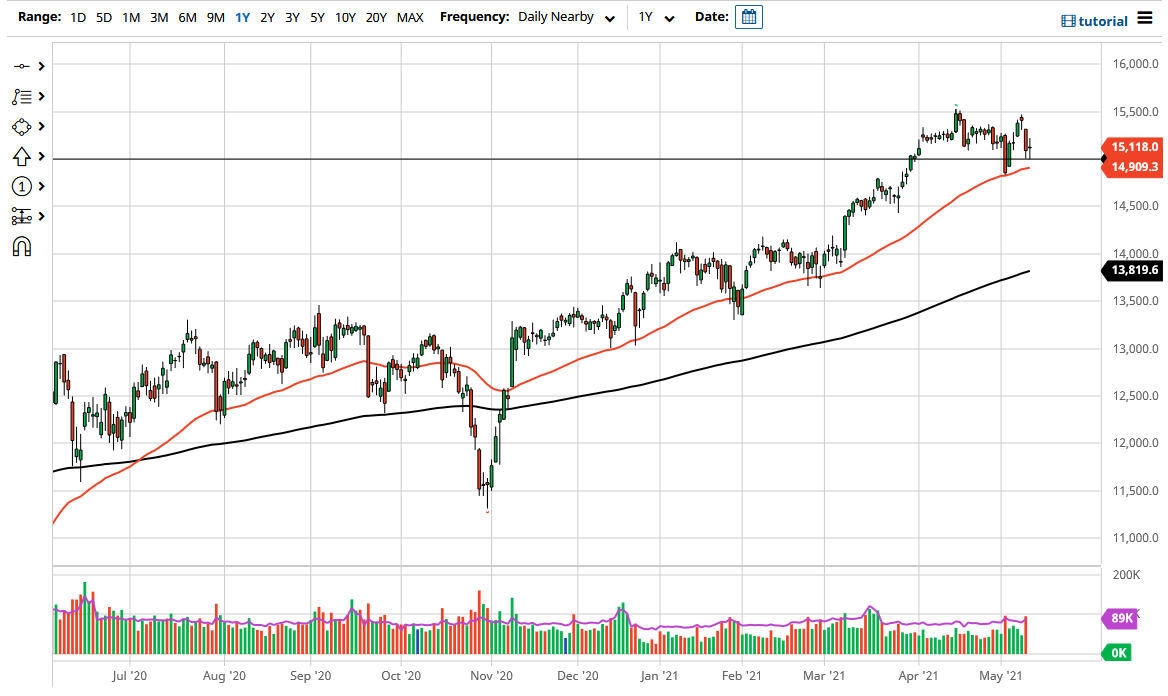

To the downside, the 50-day EMA sits just below and the 14,900 level, so I think that also adds a little bit more credence to this area offering support. Furthermore, the DAX is doing better, yet so many of the other indices suggest that this might be the first place to go if you are going to put money to work. I do believe that some type of bounce from here and perhaps a clearance of the highs from the trading session on Wednesday could open up a move to fill the gap just above, perhaps even a rally that goes to the 15,500 level.

Germany is the first place people put money to work in the European Union, as the EU is starting to reopen. If that is going to be the case, then people will be looking towards the Germans as the main driver of growth, so it makes sense that the DAX would do better than many others. Furthermore, the euro had fallen rather significantly during the trading session, so it falls into the playbook of German exports being cheaper, and therefore the DAX should rally. After all, Germany provides a lot of the industrial goods that so many economies are going to need now that they are reopening.

If we were to break down below the 50-day EMA, it opens up the possibility of a pullback towards the 14,500 level, possibly even the 14,000 level, which sits just above the 200-day EMA, which is a larger indicator that a lot of people pay close attention to. This is a market that I think continues to see plenty of support underneath, so I would not be a seller under any circumstances. Longer term, I think we will probably go looking towards the 16,000 level.