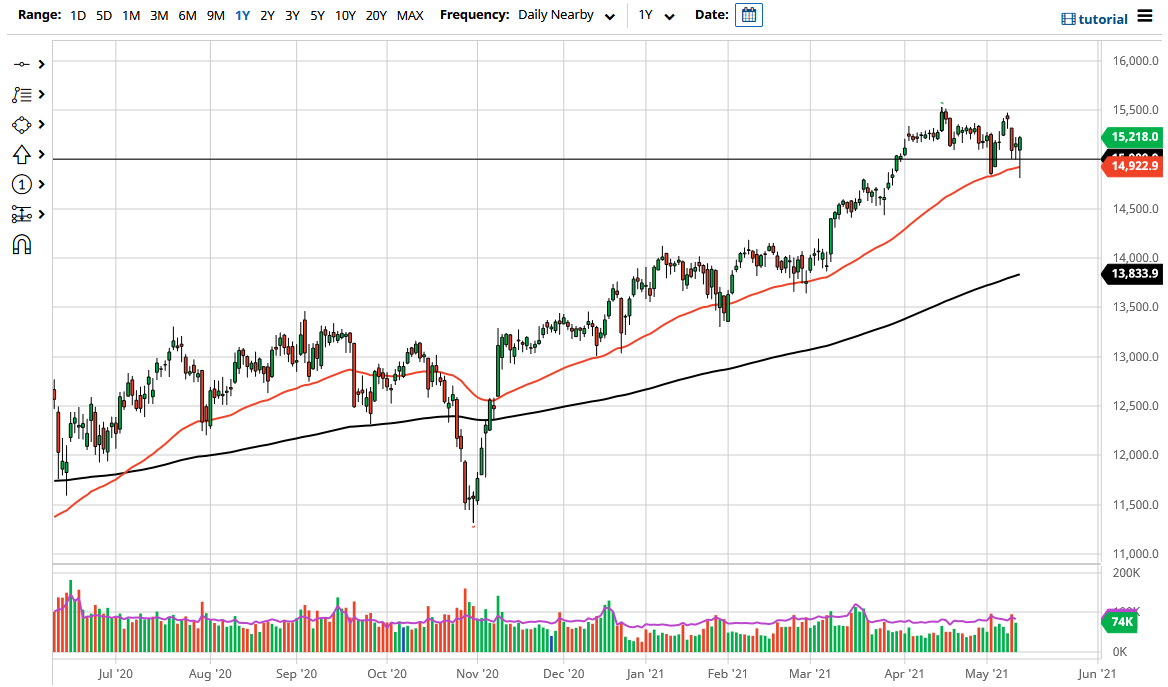

The DAX fell significantly to kick off the trading session on Thursday, perhaps in response to the inflation driven fears in America during the Wednesday session. Nonetheless, this is a market that I think continues to look bullish overall, and it seems as if the 15,000 level is an area that the buyers are more than willing to defend.

It should also be noted that the 50 day EMA has offered support a couple of times over the last week or so, so that might be something to keep in the back of your mind. We are most certainly in an uptrend, and I think we will retest that 15,500 level again. That is an area that has been very stubborn as of late, but when you look at the longer-term attitude of the chart, we have simply been “working off the froth” from the short move higher over the last month or two. This is quite typical behavior for stock markets because they do not go in one direction forever. Nonetheless, it is obvious as to what the trend is, so you need to keep that in mind. Selling this market is a great way to lose money, even if we break down below the bottom of the trading session on Thursday, which of course would be a very negative look. At that point, I would start looking for supportive action near 14,500 and even more at the 14,000 level where the 200 day comes into play.

I do believe that the DAX will continue to lead a lot of the European Union higher, as we have seen the DAX due to so many times. After all, the DAX is the first place money goes flowing towards, as it is considered to be the “blue-chip index” of the continent. Germany continues to reopen, and we have recently seen very impressive ZEW numbers, suggesting that the economy is going to continue improving going forward, so it makes sense that there will be more demand for German equities going forward as they are such a major export economy for that part of the world. Ultimately, inflation is starting to pick up everywhere, so assets such as equities will be much more impressive than hanging on to cash for most investors and/or traders.