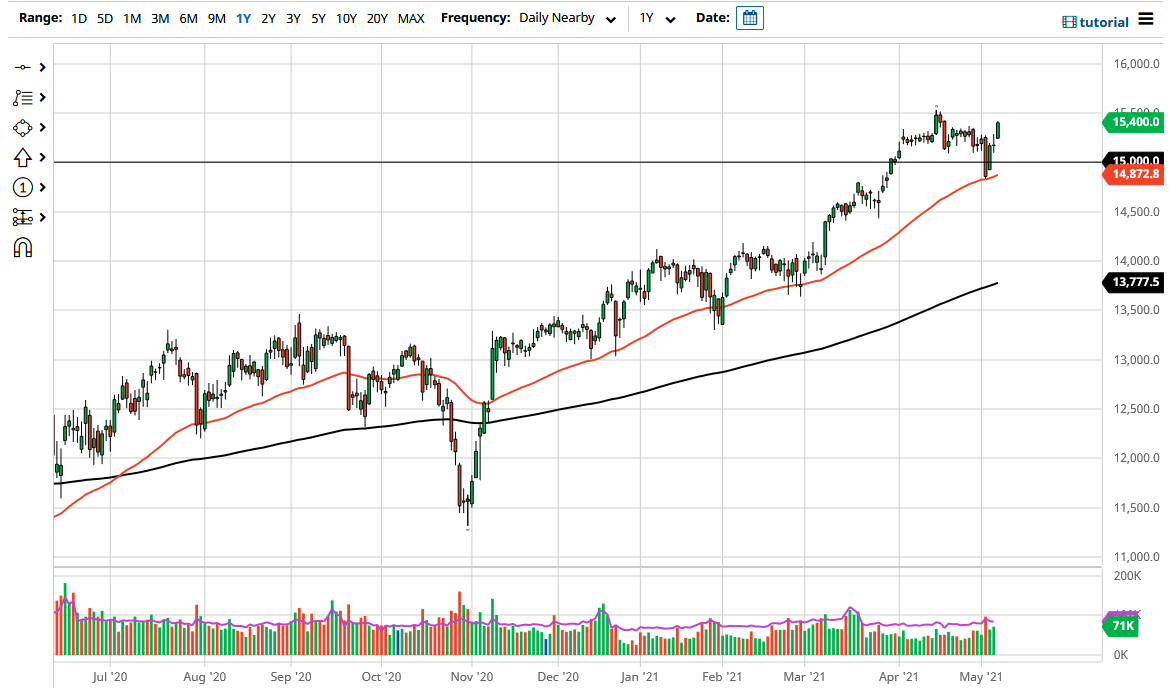

The DAX Index rallied during the trading session on Friday as we continue to recover from the massive dip that we had earlier in the week. It appears that as Germany reopens, people are trying to price in the reopening situation, which should continue to lift DAX-related companies. Remember, this is one of the first places that people will put money to work in the European Union, as it is considered to be one of the more stable indices.

The fact that we closed towards the top of the candlestick does suggest that we are in fact going to see a bit of continuation, even if we do get a little bit of a short-term pullback at the open on Monday. I recognize that the 15,500 level is an area of resistance, so I think that given enough time we are going to threaten that area. If we can break above there and close above there on a daily timeframe, I would be bullish. On the other hand, if we were to turn around and start falling again, I believe that the 15,000 level is an area that is going to be crucial for this market, as it is the previous resistance area that should now be support. Furthermore, we also have the 50-day EMA sitting just below there and reaching towards it, so I think there are plenty of reasons to believe that the market has buyers in this general vicinity.

I think the one thing you can probably count on is a lot of choppy behavior in this market right along with other stock markets, but it appears that the European Central Bank is light years away from doing anything as far as tightening is concerned, so that should continue to favor the DAX as well. Beyond that, we also have the DAX being a major exporter of heavy industrials, which is something that is very highly demanded at the moment, so it makes sense that we would continue to see money flow into this index. I have no interest in shorting, because I believe that there are plenty of value hunters willing to get involved and push this index to the upside. The candlestick for the day certainly suggests that we are going to see a bit of continuation, as traders going home over the weekend fully loaded to the upside was a significant sign of confidence.