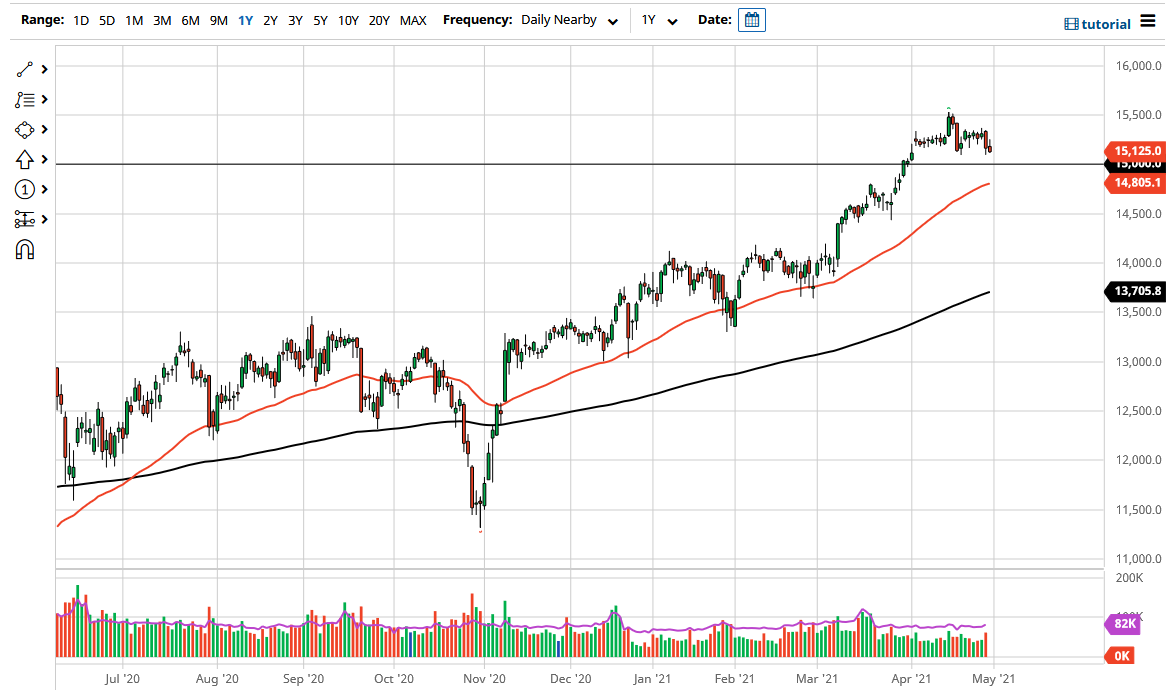

The DAX initially tried to rally during the trading session on Friday but gave back the gains it initially enjoyed. The 15,000 level underneath continues to be supportive, and the market continues to react to the idea of the big figure having a certain amount of psychological importance. Regardless, the most important thing to pay attention to here is the fact that the DAX has been in a strong uptrend for some time, and as the 50-day EMA is reaching towards the 15,000 level, that will only offer more upward momentum.

If we were to break down below the 15,000 level, it is likely that the 14,500 level would be the next support level. That being said, I do not expect this market to break down below the 50-day EMA, based upon the fact that it has been dynamic support for quite some time, as we continue to go higher. A bounce from here makes more sense than anything else, and that is exactly what I am waiting to see happen; some type of impulsive green candlestick that I can hang my hat on to start going long again. At that point, the 15,500 level would probably be the next target. That is where we recently had seen selling pressure, so it certainly makes sense that the market would go back up there to try to test that level. If we break above it, then it allows the market to go looking towards the 16,000 level next. After all, the DAX tends to move in 500-point increments, as you can see looking back over the last several months.

I do believe that this is a market that will eventually go much higher, especially as we have the “reopening trade” going on around the world and Germany is such a huge exporter for high-quality industrial products. These high-quality industrial products will be needed in order to push the economy forward in not only the European Union, but the rest of the world as well. The candlestick for the trading session does suggest that we could go a little bit lower, but I think there are plenty of buyers underneath based upon the longer-term reopening situation, and the trend in and of itself.