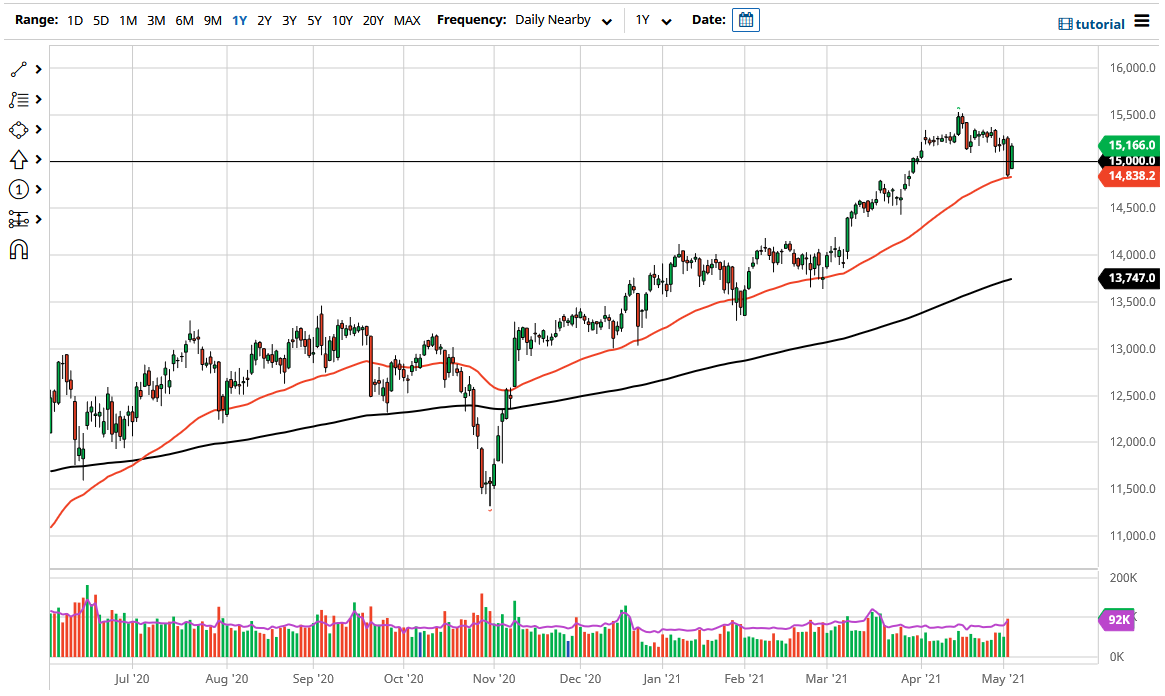

The DAX gapped higher to kick off the trading session on Wednesday, and then broke well above the 15,000 level to show signs of strength. In fact, the market gained over 300 points, so that is something worth paying attention to. The fact that the market turned around so rapidly to correct the losses from the Tuesday session tells me that there are still plenty of buyers underneath. The buyers are probably also being influenced by the 50-day EMA as well, as it has offered a bit of psychological support over the longer term.

Currently, the DAX is a beneficiary of a quieting euro and the idea of the reflation trade. Germany exports a lot of the large industrial machinery that most of the world needs in the reopening situation. Furthermore, Germany itself is the main driver of economic growth in the European Union, so the idea is that as the European Union goes, Germany will have a major part to play in it. The DAX is the first place that people put money to work on the continent as a general rule, so it does make a certain amount of sense that we have seen the DAX leading the way. Perhaps this is going to be the beginning of good upward momentum again in the whole of Europe.

If we were to break down below the 50-day EMA, then it is likely we could go down to the 14,500 level where we have seen a lot of interest previously. That is an area that would be important, but even if we broke down below there, I think it is likely that the 14,000 level would come into play, as the 200-day EMA is starting to race towards that region.

To the upside, if we can take out the top of the candlestick from the Tuesday session, then it is possible that the DAX will continue its uptrend and eventually go towards the highs again. Longer term, we could be looking at a move towards the 16,000 level above, which has been my target for some time. Obviously, the 15,000 level is an area that will attract a lot of interest, as we have seen during the previous 24 hours. I really do not have any interest in shorting this market, much like other indices around the world.