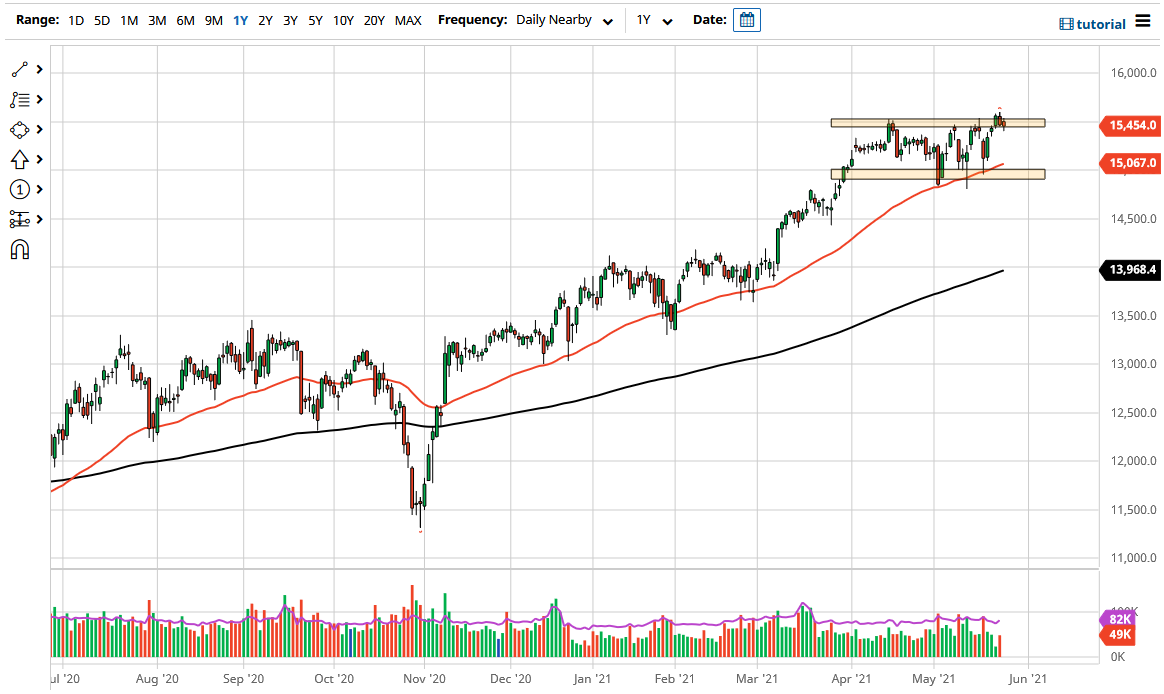

The DAX pulled back a bit during the trading session on Wednesday as the 15,500 level has offered enough resistance to turn things back around. Ultimately, we did bounce just a bit from the lows of the day, so it is likely that we will continue to go much higher. We are retesting the previous breakout, so I at this point we could see a bit of a bounce. If we make a fresh high, the market then goes looking towards the 16,000 level. That is my target for the interim, based upon the rectangle that I have marked on the chart, especially given the fact that the 50-day EMA is slicing through the bottom of it and pushing higher. Because of this, there are a lot of technical reasons to believe that this market could go higher.

At this point, the market is in an uptrend, so it certainly makes sense that we will continue to see buyers try to pick up value going forward. This is a market that I think will eventually find reasons to go higher, not the least of which would be the fact that the European Union is starting to open, and we have seen sentiment indicators in Germany pick up as of late. Because of this, the market looks as if it is trying to figure itself out, as we have seen a lot of volatility lately, suggesting that we are trying to figure out whether or not we are going to continue to go higher.

If the hammer from a couple of weeks ago pierced the 50-day EMA, then I think that we could see a significant selloff. At that point I would anticipate that the market would go looking towards the 14,500 level, possibly even the 200-day EMA underneath there that is currently sitting right around the 14,000 handle. This is a market that has plenty of support underneath, and I do think that it is only a matter of time before we take off to the upside. In general, I like buying these dips as potential buying opportunities, as when the market falls it should offer plenty of value in one of the world’s most dynamic economies.