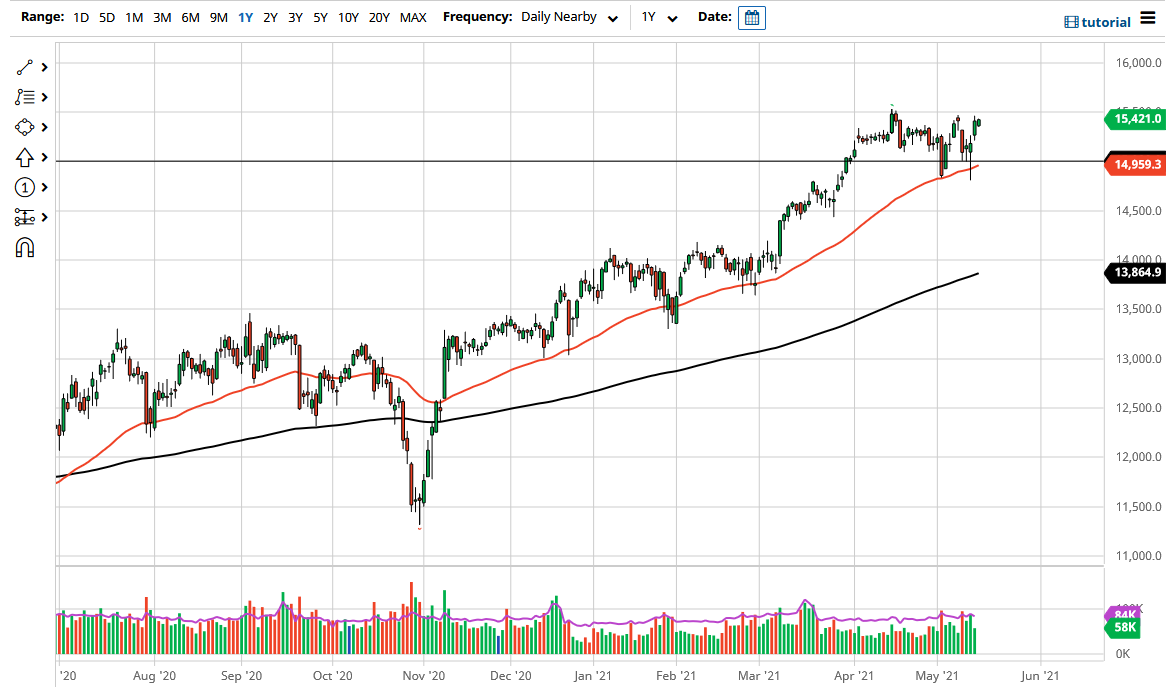

The DAX Index was slightly positive during the trading session on Monday as traders came back to work, and it looks as if it is going to continue to threaten the 15,500 level. This is an area that has been important in the past, so it would not be surpising at all to see this market struggle to get above there. However, if we get above there on a daily close, then it could open up the idea of the DAX going much higher, perhaps reaching towards the 16,000 level rather quickly.

In that general vicinity, I would anticipate a little bit of resistance, for no other reason than the fact that it is a large, round, psychologically significant figure. But it is also the “measured move” from the consolidation area that we have been in over the last several weeks, so I think ultimately this market will continue to be a “buy on the dips” situation as stock markets around the world continue to be. After all, the German index is one of the favorites of traders around the world, so when they put money to work in stocks, it makes sense that they would go rushing towards the DAX initially.

The 50-day EMA racing towards the 15,000 level adds more credence to the idea of the support at that level, so I think it will become the “floor in the market” for the remainder of the uptrend. Beyond that, the euro is starting to strengthen a little bit, perhaps in a sign that more money is flowing into the stock markets on the continent. If the DAX continues to rally, some traders may choose to spread out on the risk spectrum and go looking to other indices such as MIB, Ibex, CAC, and others.

I think that is going to be the situation at this point; people are simply looking to find assets that will outperform inflation, so we might be in a situation where it becomes more of a feedback loop then it has been in the past. In the short term, it looks like we will simply continue to go back and forth in order to find some type of momentum, and once that momentum shows up, I suspect that we have a much bigger move to the upside than we currently imagine.