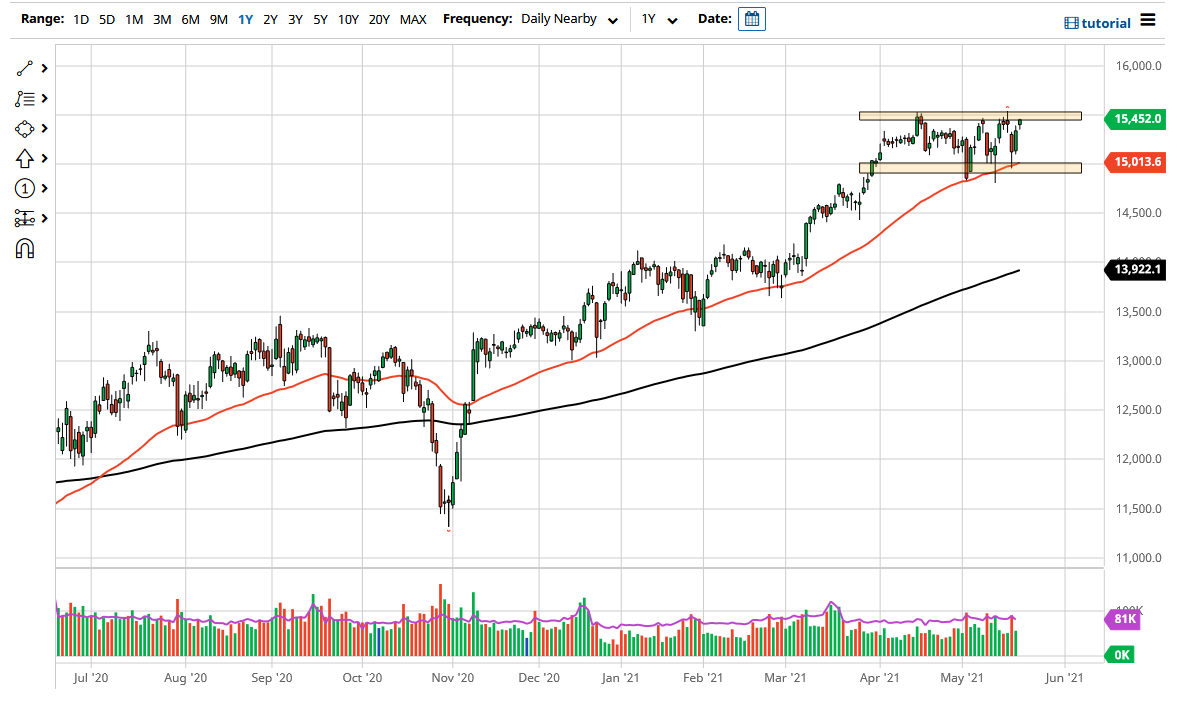

The DAX Index had a strong day on Friday to close out the week, as we gapped higher to kick off the session and then reached towards the crucial 15,500 level. That is psychologically important, and then beyond that is an area where we have seen resistance previously. Ultimately, this is a market that I think is going to break out above here, and you can look at the most recent action as a bit of a “rectangle”, so you can use the old standard of using the height of the rectangle in order to get long. The 500-point range suggests that on a break above the resistance, the market goes looking towards the 16,000 level.

In the short term, we could go back and forth during the trading session on Monday, as we start to look to go higher. We need to build up the necessary momentum to make this happen though, so do not be surprised at all if it takes a minute. The DAX is the leader when it comes to continental Europe, so it is worth paying close attention to. The market breaking above that level could open up significant bullish pressure and momentum into the stock market, so clearly at this point in time you cannot be a short seller.

The shape of the candlestick does not suggest anything other than a market that is trying to go higher. Furthermore, if we can break above the resistance barrier, then I think you can look at this area as consolidation that is going to continue into the longer-term uptrend. However, if we were to turn around and break down below the 15,000 level, we could drop as low as the 200-day EMA which currently sits just below the 14,000 level. At that point, I would anticipate a significant amount of support, as the 200-day EMA is thought of as being crucial for the longer-term trend.

Remember, the DAX is considered to be a bit of a “blue-chip index” for the continent, so it is quite often considered to be the “safest place to invest” when it comes to the stock markets in the EU. With that in mind, it is a bet on the reopening trade and the fact that the global economy is going to continue to go forward.