On the 6th of May, DOT/USD traded near 44 dollars and came within sight of record highs made on the 17th of April when the cryptocurrency touched the 48.0000 ratio. However, it has not been smooth sailing for speculators who favor pursuing the perception of bullish momentum. DOT/USD has not produced record values in what has become a standardized and expected manner like many of its major counterparts in the cryptocurrency world.

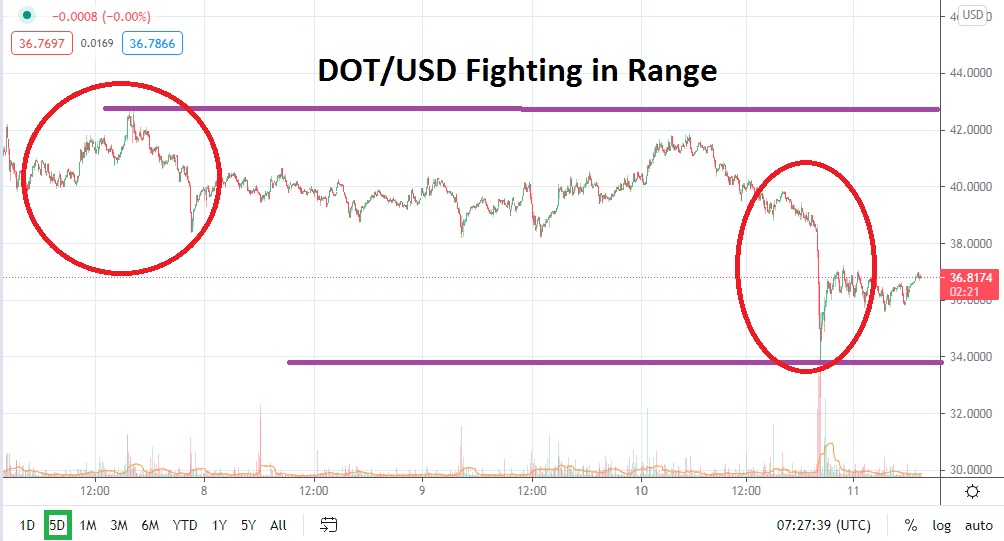

DOT/USD does remain within it higher price range, but it has certainly had to fight to maintain its stature. The current price of Polkadot is trading slightly below the 37.0000 juncture, and this comes after falling to a low of nearly 32.5000 yesterday with swift trading prevailing. In fact, DOT/USD is traversing the low rungs of its five-day price range and it will have to trade above the 38.0000 mark to generate positive sentiment from technical traders most likely.

However, what is intriguing about DOT/USD as it struggles within the lower depths of its short-term range is that support levels could prove quite capable. If the broad cryptocurrency market stays positive, DOT/USD could see buying momentum develop near perceived support levels which are relatively close. The junctures of 35.8500 to 35.2500 should be watched closely, because if these levels are sustained it could be a signal that an additional push higher will develop sooner rather than later.

The bullish trend within DOT/USD actually remains tempting as long as the broad cryptocurrency market remains optimistic. Since the 23rd of April, when DOT/USD hit a low water mark of nearly 27.0000, the cryptocurrency has been able to produce a rather incremental climb higher. Perhaps the move upward has not been as fast as speculators had hoped for, but the rather slow move higher might be a positive dynamic for conservative traders.

The current price juncture of DOT/USD is interesting because it will allow speculators to wager on their short-term sentiment. If traders believe the short-term price struggles of DOT/USD has produced too much selling, support levels may look promising as places to initiate buying positions. Now may be the time for speculative buying positions when slight pullbacks are produced to take advantage of technical perceptions.

Polkadot Short-Term Outlook:

Current Resistance: 38.5000

Current Support: 35.2500

High Target: 42.6000

Low Target: 32.5000