The Euro has rallied significantly during the course of the trading session on Friday as the retail sales number in the United States came out much lower than anticipated. This has been a tough week for traders of the Euro, because a couple of days ago we got the inflation numbers are the United States coming out much higher than anticipated. People were starting to worry about the idea of the Federal Reserve having to reverse monetary policy due to inflation, but they have stated multiple times that they are looking at any inflation right now as “transitory”, and therefore they will keep monetary policy loose for much longer than anticipated.

Further adding to the idea of inflation being transitory is the fact that the retail sales number coming out on Friday were horrible. Because of this, it shows just how noisy this market is, and of course the way people are paying attention to the idea of what the Federal Reserve is going to do. Nonetheless, Federal Reserve watchers and anybody who has been paying close attention to what they say, should know that the Federal Reserve is not going to do anything to derail the recovery.

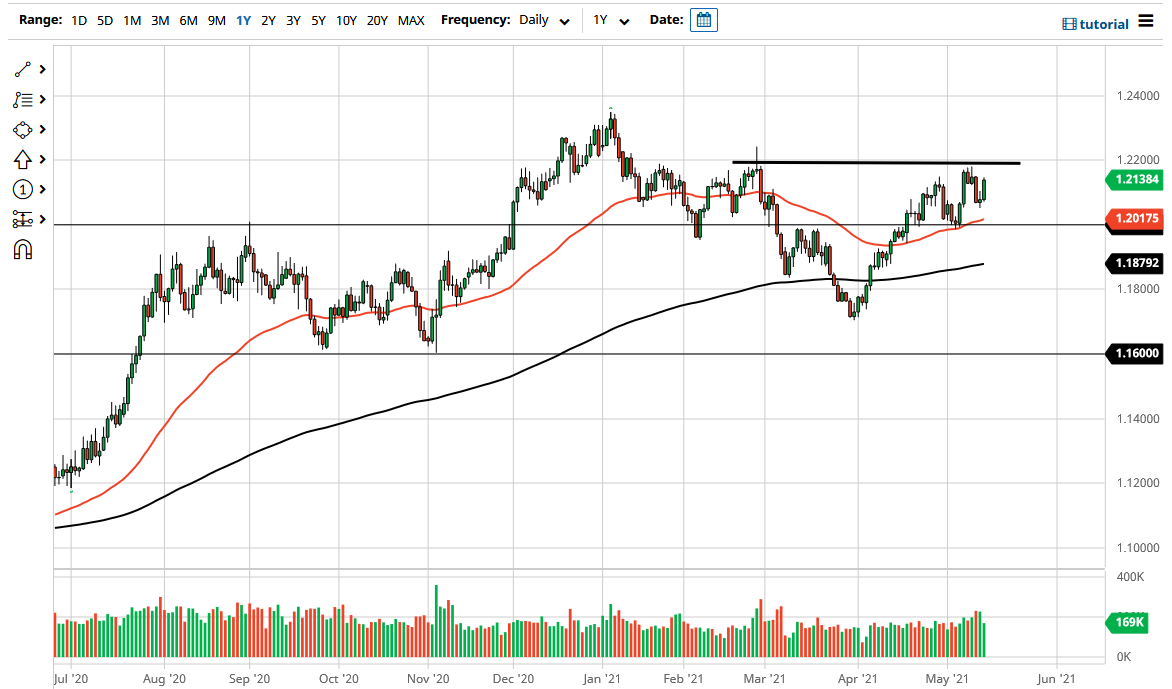

From a technical analysis standpoint, the 50 day EMA underneath should offer support, as it is now starting to cross above the 1.20 handle. This is a significant indicator that a lot of people pay attention to, and it is obvious that it will attract attention again if we drop. However, if we were to break above the 1.22 handle, then I believe that the Euro has the ability to go looking towards 1.23 level above, which has been resistance. The market has been very bullish for some time, and it seems as if we are going to go much higher given enough time.

On the other hand, if we were to break down below the 1.20 handle, then it is possible that we could go looking towards the 200 day EMA which is at the 1.1879 handle. The 200 day EMA of course is very important in general, so therefore I think a lot of people will pay close attention to it. If we were to break down below there, then it could be a trend change. However, that would more than likely be due to some type of major risk off type of event. Unless that happens, the Euro should continue to find buyers on dips.