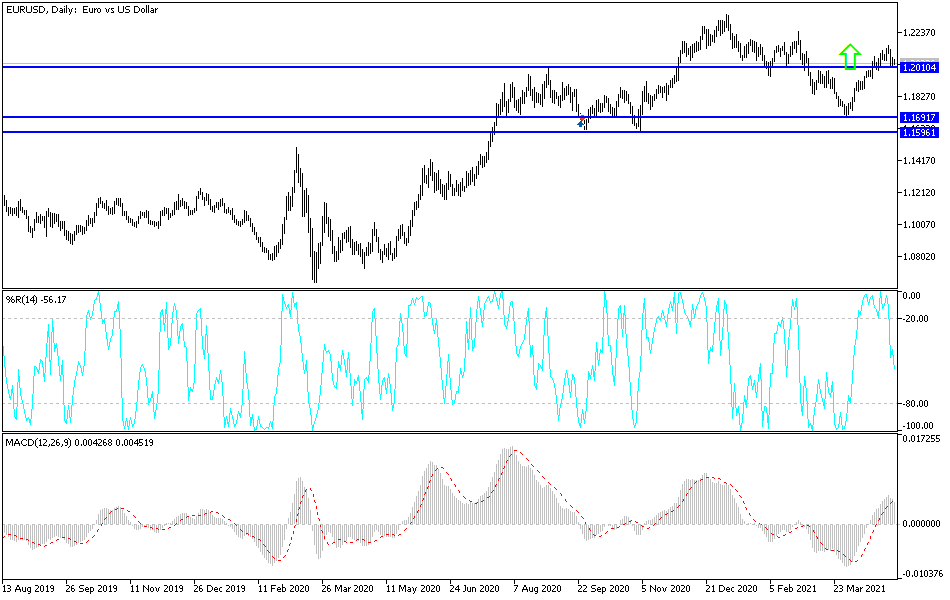

The euro recovered quite nicely during the trading session on Monday as it tested the previous downtrend line. The previous downtrend line has been rather important, but we broke above it recently only to turn around and pull back towards that area. The 1.20 handle underneath is a large, round, psychologically significant figure that will cause quite a bit of attention, just as the 50-day EMA is approaching it.

It should be noted that the last month or so has been very strong for the euro, and the way that we recovered during the trading session on Monday after such a nasty candlestick on Friday does suggest that there are still buyers getting involved and pushing to the upside. The 1.22 handle above is an area that I think the market will try to get to, and it is also an area where we have seen a lot of resistance in the past. If we can break above that level, then it is likely that we could go to the 1.23 handle, where we had pulled back from quite significantly.

On the other hand, if we were to break down below the 50-day EMA, then it is likely that we go looking towards the 200-day EMA underneath. The 1.1860 level is where the 200-day EMA currently sits, so I would anticipate that there should be a little bit of support in that area as well. If we break down below the 200-day EMA, then it is an obvious turn of events that people would be paying close attention to. Nonetheless, the US dollar seems to be on its back foot in general, so I would not be surprised at all to see the euro get a bit of a boost as a result.

Furthermore, the European economy is slated to improve, and we even got stronger German PMI numbers during the trading session, so it does make sense that the Euro got a bit of a boost as well. This is a market that I think continues to try to go higher, but it is not going to be easy to make this move. It is very unlikely that the market would chop more than anything else, but if we go higher, it is likely that the road will be tough.