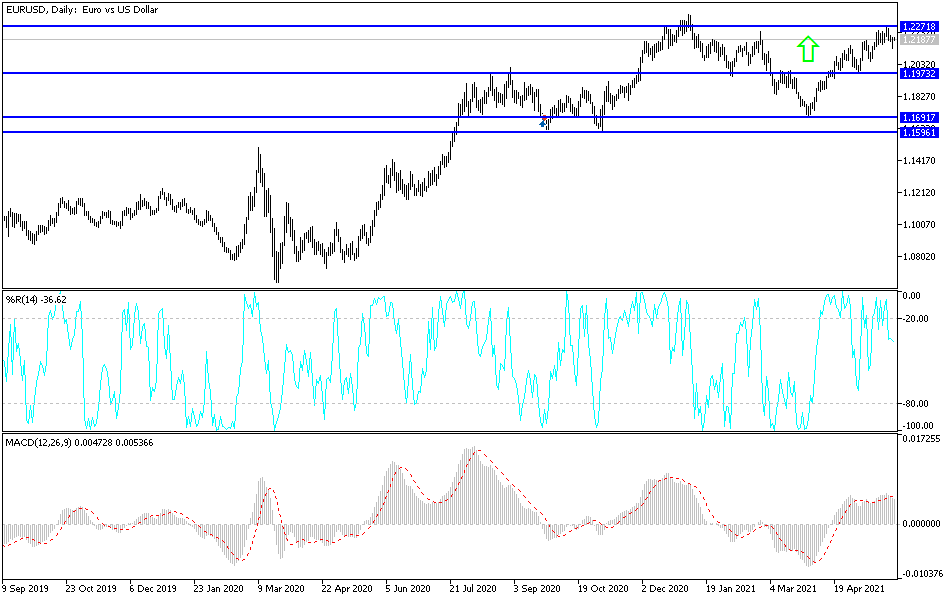

The euro initially fell during the Friday session but turned around to show signs of strength again, as we have reclaimed the 1.22 handle. By forming the massive hammer that we have, it suggests that we are going higher, and will eventually build up enough momentum to break out above the horizontal line that I have marked on the chart. If we do that, it opens up the possibility of a move towards the 1.23 level, where we had seen significant resistance in the past.

If we can break above that level, then I think the market will eventually go looking towards 1.25 handle, but it should be noted that the euro tends to be very choppy to say the least; and it should also be noted that a line of the movement to the upside was done during US trading, which is a little less liquid on Fridays than other parts of the world. Regardless, we are in an uptrend, and this simply continues the overall ascending channel that we have been in, as well the theme of the US dollar losing strength overall.

If you look to the left, you can see that the 1.2150 region had been significant resistance previously, so the fact that we have found a little bit of support there should not be a major surprise, as we continue to see the greenback get sold off against almost everything. This will continue to be the theme going forward, but we might get the occasional pullback in this market. In general, I do believe that we will see this market break out and go looking towards 1.25 handle, but that might be a story for summertime more than anything else.

If we break down below the bottom of the candlestick from the Friday session, then the 50-day EMA comes into the picture, and most certainly after that we would probably see the 1.20 level offer support as it is important for not only the psychological but also structural standpoint. The market has paid close attention to the 1.20 handle multiple times in the past, so it is most certainly worth paying attention to in the future if we do get down there. This looks like a pair that is ready to continue pressing to the upside until we get the breakout.