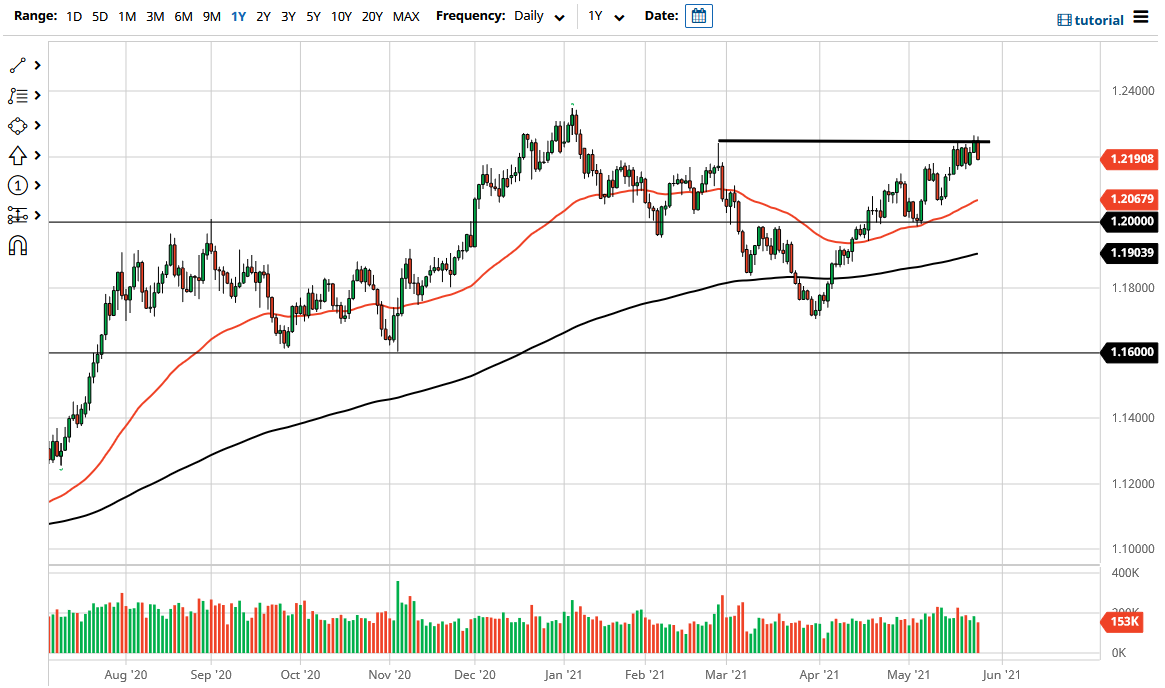

The euro broke down a bit during the trading session on Wednesday as we continue to see a lot of selling pressure just above. We are getting close to the top of the overall consolidation range, with the 1.23 level being a major barrier to higher prices. If we can break above there finally, then the market is likely to go looking towards the 1.25 handle, but I do not see that happening anytime soon. With this being the case, I anticipate that we will continue to see a lot of choppy behavior, but also recognize that the trend is still fraught with issues.

When you look at the chart, you can see that the candlestick from the trading session on Wednesday was very ugly; but ultimately, this is a market that I think you need to pay close attention to, because it gives us an overview of what is going to happen with the US dollar in general. If it continues to fall, that could show significant strength for the greenback going forward, and although I would not be a seller of this market, we could make an argument for buying the greenback against other currencies.

I do believe that eventually we will find support underneath, especially near the 1.21 level, and lower at the 1.20 level. The 1.20 level is a large, round, psychologically significant figure that a lot of people pay close attention to, and also has the 200-day EMA racing towards it. Because of this, most traders will look at this as an opportunity to pick up a bit of value. If we were to break down below the 1.20 handle, then we could very well start to see more significant selling pressure. In the short term though, I think the market continues to be very noisy and choppy, but the long term will more than likely favor the potential breakout. After all, the US dollar has been on its back foot for a while and the Federal Reserve continues to be very loose with monetary policy. Nonetheless, we also need to take a look at the European Union, which is starting to show signs of strengthening and waking back up as well. If that is going to continue to be the case, that should favor this pair going higher eventually, but we may be just a little over-extended.