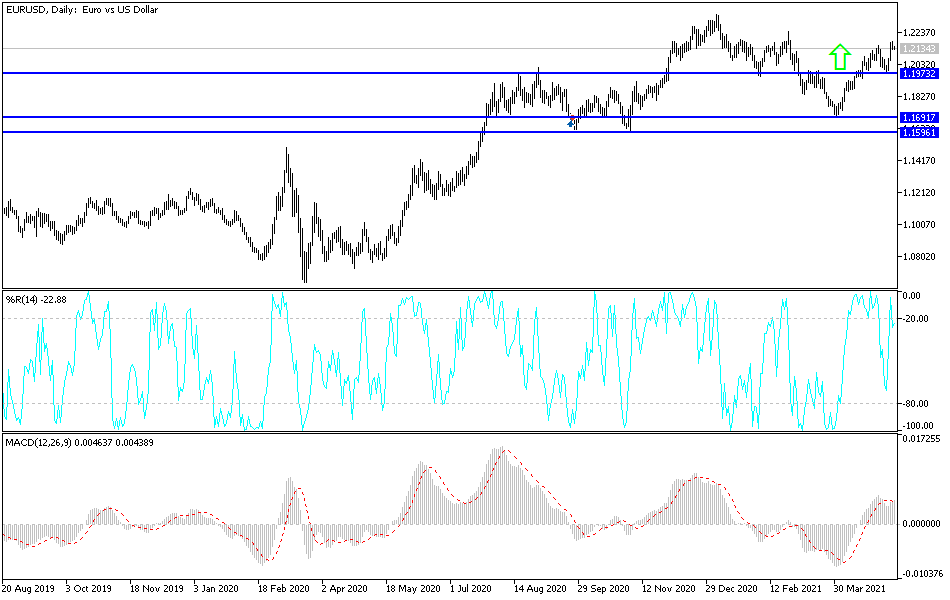

The euro was very quiet during the trading session on Monday as traders came back to work and sold off the US dollar against most other things, but the euro lagged. This suggests to me that the 1.22 handle above is going to continue to offer resistance, so I think that a pullback is more than likely going to be thought of as a buying opportunity. I believe that the 1.20 handle is a significant support level based upon the previous action, and the fact that the 50-day EMA is coming back into play. The market is likely to continue to see a lot of volatility, and I certainly think that a pullback makes sense.

That being said, the pullback is going to be a buying opportunity, as we have seen a significant shot higher. The fact that the Friday candlestick was so strong and closed towards the top of the range is a good sign, but the Monday candlestick left a lot to be desired. This suggests that the pullback coming will be thought of as an opportunity, just as a daily close above the 1.22 level should be a buying opportunity. Breaking above there opens up the possibility of a move to the 1.23 handle, where we had seen previous selling.

If we were to somehow break down below the 50-day EMA, especially on a daily close, then I would expect this market to go down to the 1.1870 area, where the 200-day EMA is sitting at currently. If that level were to get broken, then it would obviously be very negative. Nonetheless, when you look at this market you can see that we have just made a “higher high”, so as long as we can stay above the most recent low, then it would be a buying opportunity again as it would simply be a “higher low.”

The US dollar itself is under a lot of strain, so that should eventually help the euro, but the European Union is a bit sluggish itself, and this pair is typically quite tight and choppy to say the least. I anticipate that we will have plenty of buyers coming into pick this pair up to go much higher.